Summary:

Based on industry data from 2021 to July 2025, this paper briefly analyzes China’s glufosinate-ammonium exports, covering core dimensions such as export volume, product structure, destinations and price trends, noting its characteristics of fluctuating growth, formulations surpassing technical products for the first time, highly concentrated markets affected by policies, and stabilized prices; the industry has opportunities from substitution of similar herbicides and promotion of transgenic crops, as well as challenges of overcapacity and trade barriers, with exports expected to maintain growth in 2025.

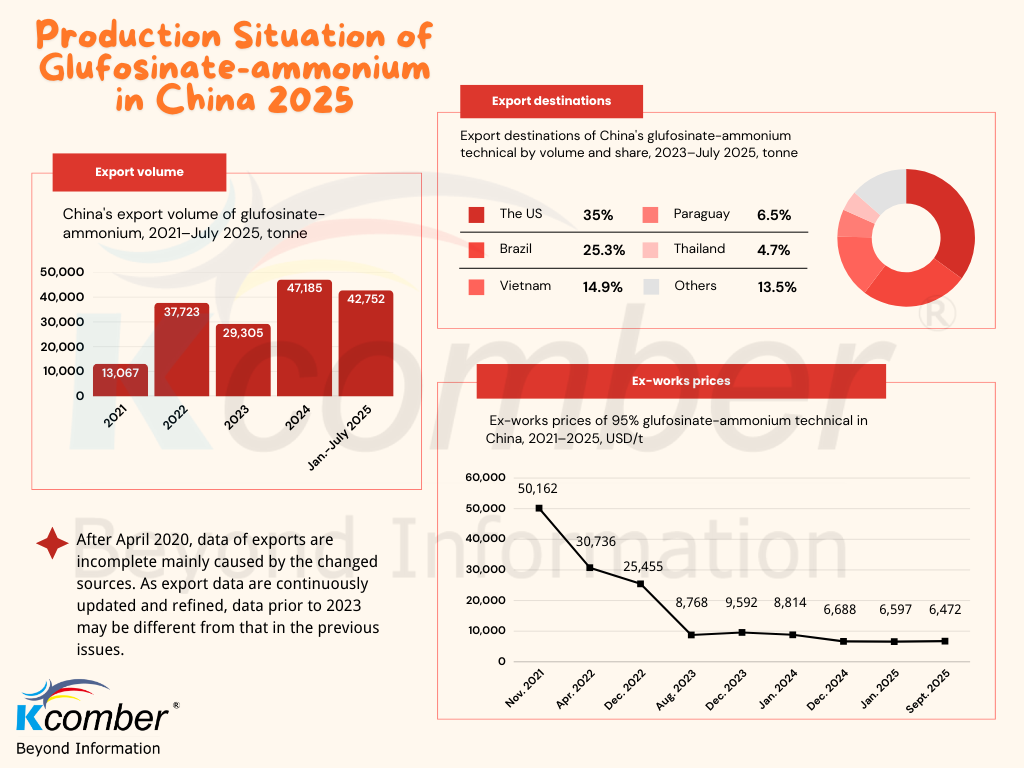

I. Export Volume: Fluctuating Growth with Strong 2025 Momentum

China’s glufosinate-ammonium exports (converted to 100% AI) saw volatility but overall growth. After a COVID-19-induced dip to 5,118 tonnes in 2020, exports rebounded to 13,067 tonnes (up 155.3% YoY) in 2021 and surged to 37,723 tonnes (up 188.7% YoY) in 2022. A 22.3% YoY drop to 29,305 tonnes occurred in 2023 due to overseas overstock and weak demand, but 2024 brought a 61% YoY rebound to 47,185 tonnes as global destocking ended. By July 2025, exports reached 42,752 tonnes, with full-year projections to exceed 2024’s level.

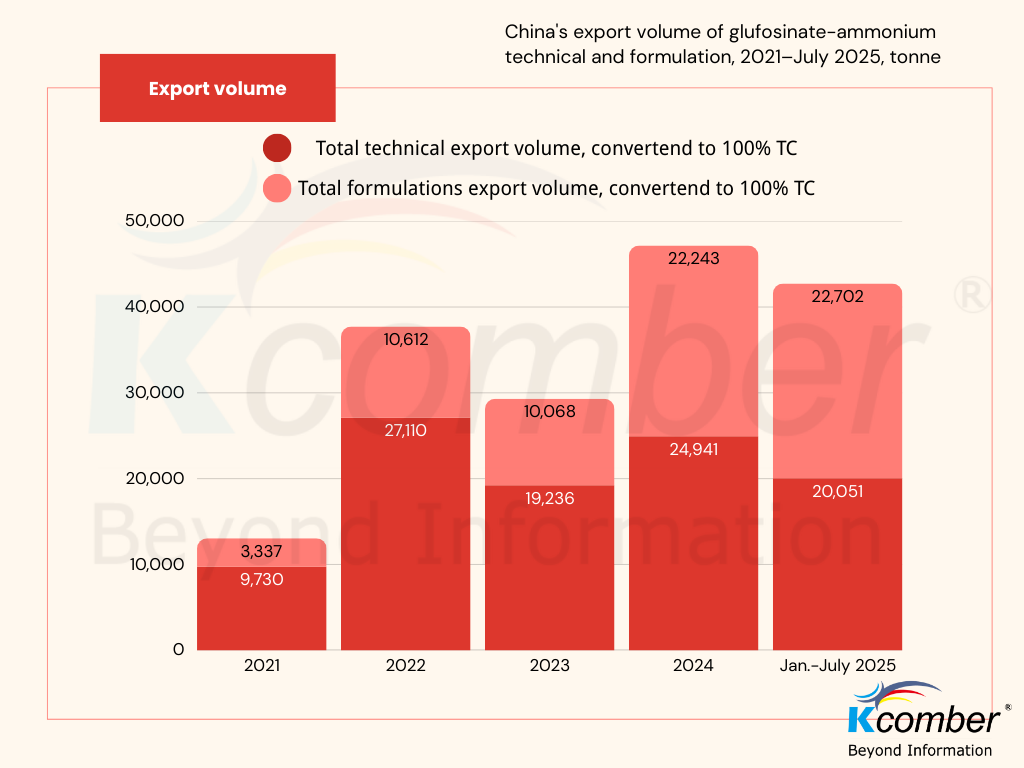

II. Product Structure: Formulations Surpass Technical Products

China exports both technical (TC) and formulation products. TC dominated with a 59.4% average share (2021–July 2025), but formulations gained traction: 22,243 tonnes (47.1% share) in 2024, and 53.1% share (22,702 tonnes) in Jan.–July 2025—surpassing TC for the first time. 95% TC and 88% SG are the leading export specifications.

III. Export Destinations: Concentrated Markets with Policy Impacts

The US, Brazil, Vietnam, Thailand, and Cameroon accounted for 82.3% of total exports (2021–July 2025). For TC (Jan.–July 2025), the top five importers (US, Brazil, Vietnam, Malaysia, Indonesia) captured 88.9%; for formulations, Cameroon, Brazil, Nigeria, Vietnam, and the US made up 85.4%. India’s 2025 five-year anti-dumping duty drastically cut China’s exports to India—from 1,030 tonnes (2023) to 24 tonnes (Jan.–July 2025).

IV. Price Trends: From Volatility to Stabilization

95% TC ex-works prices peaked at USD50,162/t (Nov. 2021) due to supply shortages and raw material hikes, then fell to USD25,455/t (Dec. 2022) as capacity expanded. A sharp 66% drop to USD8,768/t (Aug. 2023) followed weak demand, with 2024 seeing a 23% full-year decline to USD6,668/t amid overcapacity. 2025 brought stabilization: prices edged down 1.89% from Jan. (USD6,597/t) to Sept. (USD6,472/t), with a modest rebound in August as industry sentiment improved.

V. Opportunities & Challenges

Opportunities stem from glyphosate/paraquat restrictions (carcinogenicity concerns, bans in Thailand/Brazil) and widespread approval of glufosinate-ammonium-resistant transgenic crops (over 20 crops globally). Challenges include overcapacity (global TC capacity rose from 52,095 t/a in 2021 to 154,970 t/a in 2025) and trade barriers like India’s anti-dumping duties.

Outlook

China’s glufosinate-ammonium exports are set to maintain growth in 2025, driven by substitution demand and transgenic crop adoption. Enterprises should optimize formulation production, diversify markets, and address overcapacity to consolidate global competitiveness.

About CCM

CCM is a leading market intelligence provider in China, serving the agriculture, chemicals, food & feed, and life sciences industries. Founded in 2001, CCM delivers price monitoring, trade analysis, and customized market research services. CCM also provides advertising and promotion solutions for food ingredients and sweeteners suppliers, helping companies increase visibility and connect with targeted global buyers.

Website: www.cnchemicals.com Email: econtact@cnchemicals.com Tel: +86-20-37616606