In Q2 2016, the Chinese listed fluorochemical companies successively released

their full-year 2015 financial reports. In order to make it clear about the

industry status quo and development trend, CCM specifically selected 4 listed companies to make systematic analysis.

Source: Internet

In Q2 2016, the Chinese listed fluorochemical companies successively released

their full-year 2015 financial reports. Accordingly, most of the companies

reversed the declines and stabilised their performances. In particular, some

companies achieved significant growths in profit, since they continuously

carried out transformation and upgrading, including product structure

optimisation (into downstream deep processing), new/ modified material development

and new application exploitation. For instance, Do-Fluoride Chemicals Co., Ltd.

(Do-Fluoride) and Zhejiang Yongtai Technology Co., Ltd. (Zhejiang Yongtai)

recorded a rise of 310.51% and 72.69% YoY in net profit.

In order to make it clear about the domestic fluorochemical industry status quo

and development trend, analyst CCM specifically selected 4 leading listed

companies to make analysis on their financial figures in 2013-2015, with regard

to the overall performance, profit, assets, debt risk, R&D input and

projects under construction.

The 4 companies are Do-Fluoride, Shanghai 3F New Materials Co., Ltd. (Shanghai

3F), Zhejiang Juhua Co., Ltd. (Zhejiang Juhua) and Zhejiang Yongtai.

I Overall performance

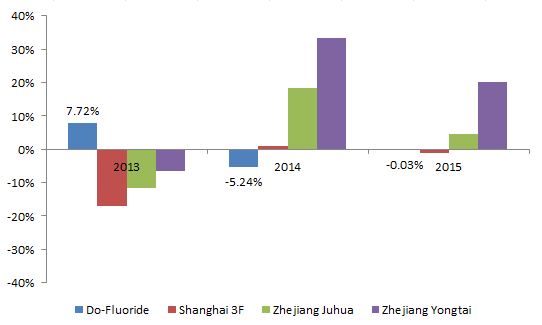

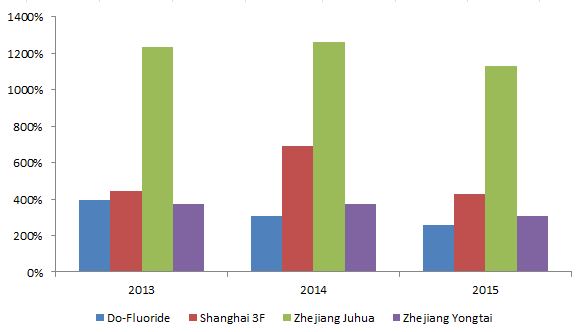

1. Revenue growth rate (fluorochemical business only)

Zhejiang Juhua and Zhejiang Yongtai realised considerable growths in 2015, by

4.43% and 20.27% YoY respectively, signalling rises in 2 consecutive years. By

contrast, Shanghai 3F and Do-Fluoride showed negative results, by -1.24% and

-0.03%. Notably, Do-Fluoride improved significantly compared to -5.24% in 2014.

This to certain extent meant that the domestic fluorochemical industry was

recovering in 2015.

Specifically,

- Zhejiang Yongtai: thanks to the rises in sales from fluorine-enriched

refrigerants (up by 13.76%) and fine fluorochemicals (up by 7.52%)

-

Fluorine-enriched refrigerants: combined sales volume up by

11.07%, due to the substantial rises in sales volumes of refrigerant

mixes, HFC-125, HFC-134a aerosol can, etc. Note: refrigerant mixes

involved R410a (a mixture of difluoromethane – HFC-32 and

pentafluoroethane – HFC-125), R404A (a mixture of HFC-125,

1,1,1,2-tetrafluoroethane – HFC-134a and trifluoroethane – HFC-143a), and

R407C (a mixture of HFC-32, HFC-125 and HFC-134a)

-

Fine fluorochemicals: combined sales volume up by 45.16%, owing

to the strong demands for 2-bromoheptafluoropropane and suchlike

- Zhejiang Yongtai: mainly involved in fine chemicals business

(specifically the fluorobenzene series), comprising 3 categories based on

different applications, namely agrochemicals, pharmaceutical chemicals and

liquid crystal chemicals.

In the context that the downstream industries went up continuously, the company

vigorously expanded the market at home and abroad, by largely improving the

production and sales scales. In 2015, the said 3 product categories recorded a

rise of 2.05%, 20.15% and 29.52% separately in sales. The combined output and

sales volume was up by 17.78% and 16.01% respectively.

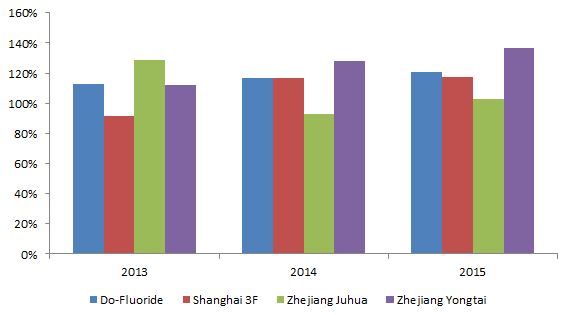

2. Capital maintenance and increment ratio

The 4 listed fluorochemical companies attained certain increases. Of this,

Zhejiang Yongtai recorded the highest, at 136.49%, whilst Zhejiang Juhua

maintained the lowest, at 102.63%, despite the growth from 92.82% in 2014. This

indicated that Zhejiang Juhua, in recent two years, has fallen behind in

capital maintenance and shareholder equity growth.

According to CCM's research, Zhejiang Juhua made the rise by:

-

Giving full play to its advantages in supply chain, scaled

technology, brand and sales channels, to expand the market and finally

stabilise the operation of main business

-

Carrying out secondary innovation on production facilities and

management innovation, including cutting down the number of staff, saving

energy, decreasing consumption, improving rate of quality product, and

levelling up labour productivity, to finally reduce costs and raise efficiencies,

promote efficiency of stock assets and enhance competitiveness

Notably, the new projects launched by Zhejiang Juhua for premium-oriented

development, were mostly under investment and construction in 2015, yet to

bring scaled effect. This also led to its fairly low capital maintenance and

increment ratio.

Revenue growth rate, 2013–2015

Source: Company reports & CCM

Capital maintenance and increment ratio,

2013–2015

Source: Company reports & CCM

II Profit

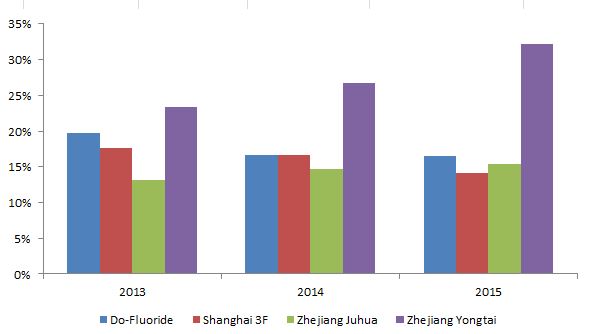

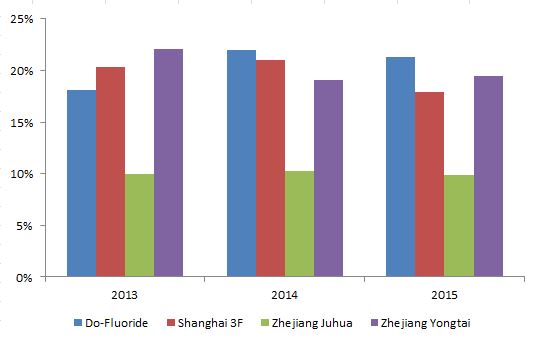

1. Gross profit margin (fluorochemical business only)

Do-Fluoride and Zhejiang Juhua, despite small fluctuations, kept relatively

stable in gross profit margin, whilst Shanghai 3F saw a fall of 2.54 percentage

points YoY.

In particular, Shanghai 3F was the only company amongst the 4 selected ones

that suffered losses in 2015, at -USD47.63 million (-RMB307.51 million, vs.

+USD7.61 million (RMB49.14 million) in 2014). This is mainly because:

-

The demands for some knockout products declined. For instance,

the sales volume of difluorochloromethane (HCFC-22), chlorotrifluor

ethylene (CTFE) and polyvinylidene fluoride (PVDF) each fell by 9.80%,

6.08% and 0.13%

-

It was advancing the premium-oriented transformation and

capacity transfer. Specially it repositioned its 3 production bases

(Shanghai, Changshu City in Jiangsu Province and Inner Mongolia Autonomous

Region): some production equipment (for polytetrafluoro ethylene (PTFE)

for example) was suspended for reconstruction, and new projects (for

hexafluoropropylene (HFP) and 2,3,3,3-tetrafluoropropene (HFO-1234yf) for

example) were mostly under construction. All this resulted in the big

rises in administrative expenses and R&D input, by 48.47% and 34.44%

Averagely, the gross profit margin of the aforementioned 3 companies was only

15.34% (vs. averaged about 17% for domestic basic chemicals industry). This

meant that the domestic fluorochemical industry did not make satisfactory

profit, even though it was at a recovery. This can be mainly ascribed to the

severe overcapacities of mainstream products, such as hydrogen fluoride

(HF), aluminium fluoride (AlF3), fluorine-enriched refrigerants

and fluoropolymer.

Gross profit margin, 2013–2015

Source: Company reports & CCM

Zhejiang Yongtai outshone the other 3

companies, specifically regarding the gross profit margin, and maintained

upturns (from 23.30% to 32.20%) in 2013-2015.

This is mainly because Zhejiang Yongtai has been dedicated to the fine

fluorochemicals business and has made innovations in application (for

pharmaceuticals, pesticides and liquid crystal materials), which has brought

more opportunities to the company. Meanwhile, the company has focused on

extending and expanding the supply chain based on its advantaged products, to

continuously strengthen its competitiveness and voicing power in the market.

Accordingly:

-

Pharmaceuticals: stable sales of intermediates applicable to

sitagliptin/ moxifloxacin, and environmental impact assessment on the

intermediate for sofosbuvir passed

-

Liquid crystal materials: monomer liquid crystal product sold

at home and abroad, and color film photoresist accepted by domestic target

clients and produced at small scale

-

Pesticides: stable supplies of several ordered pesticide

intermediates; acquisition of 100% of stake in Shanghai E-Tong Chemical

Co., Ltd. to obtain large quantities of overseas registration certificates

of pesticide technical and formulations and achieve complementation of

domestic and foreign sales channels; strategic cooperation with Chongqing

Chemical & Pharmaceutical holding (Group) Company, to enrich the

product line and extend into pesticide technical and formulations

In reality, if the domestic fluorochemical companies intend to get out of the

dilemma (low gross profit margin), they should actively exploit the emerging

markets, in addition to continuing extending the supply chain and developing

premium-marketed products.

Take Do-Fluoride for example. It has marched into the Li-ion battery key

materials (such as electrolyte and cathode materials), power Li-ion battery and

alternative energy vehicle businesses, based on its lithium hexafluorophosphate

(LiPF6) production capacity layout. It aims to specifically build a

business of alternative energy, following the fast development of the said

emerging markets. According to CCM's research, Do-Fluoride achieved a rise of

143.25% in its sales from alternative energy business in 2015. The

corresponding gross profit margin was up to 33.82%.

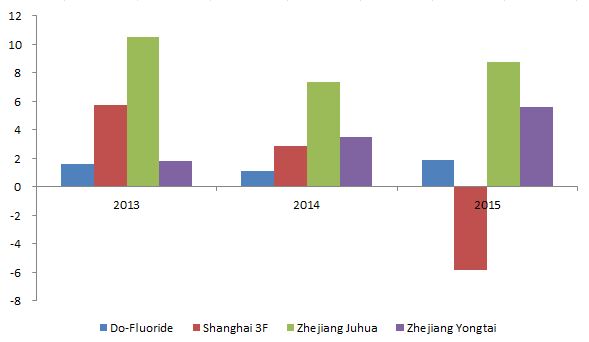

2. Return on common shareholders' equity (ROE) and return on total assets

(ROA)

Almost literally, Zhejiang Yongtai was in the lead, at 7.87% and 7.32%

separately. This showed its better business operation and profitability than

the other 3 companies in 2015.

Driven by the alternative energy business, Do-Fluoride also made rapid

improvements regarding the 2 indices, at 1.58% and 2.86% (vs. 0.47% and 1.81%

in 2014).

ROE and ROA, 2013–2015

|

ROE

|

|

Year

|

Do-Fluoride

|

Shanghai 3F

|

Zhejiang Juhua

|

Zhejiang Yongtai

|

|

2013

|

1.01%

|

6.24%

|

3.66%

|

1.79%

|

|

2014

|

0.47%

|

2.35%

|

2.22%

|

5.98%

|

|

2015

|

1.58%

|

-11.33%

|

2.26%

|

7.87%

|

|

ROA

|

|

Year

|

Do-Fluoride

|

Shanghai 3F

|

Zhejiang Juhua

|

Zhejiang Yongtai

|

|

2013

|

1.83%

|

5.65%

|

3.94%

|

3.28%

|

|

2014

|

1.81%

|

3.76%

|

2.70%

|

5.69%

|

|

2015

|

2.86%

|

-5.77%

|

2.78%

|

7.32%

|

Note: ROE stands for return on common shareholders' equity;

ROA stands for return on total

assets.

Source: Company reports & CCM

III Assets

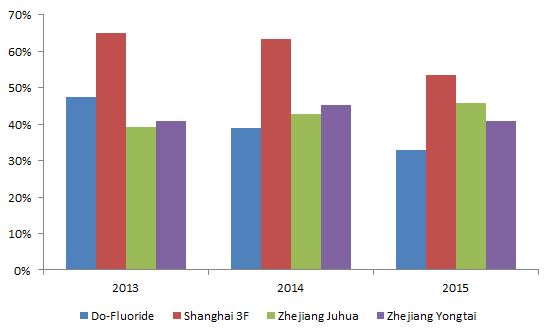

1. Assets turnover (fluorochemical business only)

Except Zhejiang Juhua, the other 3 companies presented varied declines. This

manifested that Zhejiang Juhua performed fairly well in view of operating

efficiency, sales capability and assets utilisation efficiency.

The average figure of the 4 companies was only 43.26%, which to certain degree

reflected that the domestic fluorochemical industry in fact did not do a good

job in production and sales. Notably, the average figure of the petrochemical

industry was over 100%, according to statistics.

2. Receivables turnover (fluorochemical business only)

Zhejiang Juhua still maintained a relatively high level (at 1131.78%), in the

context that the 4 companies all showed falls. In light of the higher figures

given by Zhejiang Juhua, it can be concluded that the company was able to use

funds at higher efficiency and was more capable of debt repayment.

Assets turnover, 2013–2015

Source: Company reports & CCM

Receivables turnover, 2013–2015

Source: Company reports & CCM

IV Debt risk

1. Balance ratio

Do-Fluoride and Shanghai 3F witnessed small falls, whilst Zhejiang Yongtai

realised a slight rise. Specifically, Zhejiang Juhua was the one holding the

lowest balance ratio, at 9.87% only.

The average figure was 17.13%. Compared to that of about 56% for the overall

chemical industry, the fluorochemical segment performed well in business

operation and risk control.

However, this also signalled that the domestic fluorochemical industry was not

active enough and still under stable operation. The ever development pattern

involving continuous production expansion and business operation under large

debts, is not applicable to the current industry. The trend to develop

"premium, refined and specialised' products should be a necessity.

2. Times of interest earned

Except Shanghai 3F of which the figure was negative due to the loss, the other

3 companies all achieved growths. This meant that the domestic fluorochemical

industry overall enhanced the capability to repay debts. Still, Zhejiang Juhua

recorded the highest level, at 8.78.

Balance ratio, 2013–2015

Source: Company reports & CCM

Times of interest earned, 2013–2015

Source: Company reports & CCM

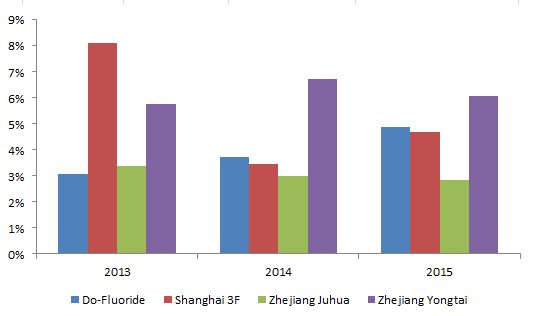

V R&D input

In light of the proportion of R&D input in revenue from fluorochemical

business, Do-Fluoride and Shanghai 3F respectively made up 4.89% and 4.68%, up

by 1.18 and 1.24 percentage points, marking leading growths in the industry.

This mainly came from their investments into downstream projects in 2015.

Though Zhejiang Yongtai presented falls, the figure at 6.07% still got a good

lead in the industry. Actually, the company should maintain the investment into

its fine fluorochemicals business which is oriented by technology, to keep the

competitiveness.

Proportion of R&D input in revenue from

fluorochemical business, 2013–2015

Source: Company reports & CCM

VI Key projects under construction

According to CCM's analysis on the projects under construction:

-

Production capacity now under operation: the domestic

fluorochemical companies are mainly optimising production process, and

achieving procedure automation to cut down costs and improve economic

effects

-

Production capacity newly established: the domestic

fluorochemical companies are mainly targeting at developing premium,

deeply-processed and refined products, including new generation

fluorine-enriched refrigerants, high performance fluoropolymers, new

fluorine-enriched materials and fine fluorochemicals. Meantime, they are

stepping into emerging markets, such as the electronic chemicals, Li-ion

battery and related key materials and pharmaceutical preparations

Key projects under construction in 2015

|

Company

|

Total investment

|

Fields involved

|

Key projects under construction

|

|

Do-Fluoride

|

USD26.73 million (RMB172.58 million)

|

Inorganic fluorides, fine

fluorochemicals, and Li-ion battery and related key materials

|

Dry process high performance aluminium

fluoride (AlF3) project

|

|

Fluosilicic acid based anhydrous hydrogen

fluoride (AHF) project with white carbon black co-produced

|

|

Fine fluorochemicals project

|

|

High purity crystal lithium

hexafluorophosphate (LiPF6) project

|

|

Power Li-ion battery project

|

|

Li-ion battery separator experiment

production line project

|

|

Shanghai 3F

|

USD69.04 million (RMB445.74 million)

|

Hydrofluorocarbons (HFCs),

hydrofluoroolefins (HFOs) and fluoropolymers

|

1,1,1,2-Tetrafluoroethane (HFC-134a)

reconstruction project

|

|

2,3,3,3-Tetrafluoropropene (HFO-1234yf)

project (Phase 2)

|

|

1,1,1,4,4,4-Hexafluorobutene

(HFO-1336mzz) project

|

|

Fluoropolymer technological

reconstruction project

|

|

Tetrafluoroethylene (TFE) and

polytetrafluoro ethylene (PTFE) production expansion project

|

|

Hexafluoropropylene (HFP) project

|

|

Zhejiang Juhua

|

USD79.17 million (RMB511.18 million)

|

HFCs, fluoropolymers, new

fluorine-enriched materials and electronic chemicals

|

Pentafluoroethane (HFC-125) project

|

|

Perfluoropropane (HFC-245fa) project

|

|

Polyvinylidene fluoride (PVDF) project

|

|

LiPF6 project

|

|

Fluorinated ethylene propylene (FEP)

production expansion project

|

|

New fluorine-enriched materials project

|

|

Fluorine-enriched special gas project

|

|

High purity electronic gas project

|

|

Electronic chemicals (wet) project

|

|

Zhejiang Yongtai

|

USD24.84 million (RMB160.37 million)

|

Infrastructure, fluorine-enriched

pharmaceutical intermediates and pharmaceutical preparations

|

Office buildings

|

|

Workshop reconstruction

|

|

Mining roadway project

|

|

Shandong Zhanhua Yongtai Pharmaceutical

Co., Ltd.'s second phase project

|

|

Zhejiang Yongtai Pharmaceutical Co.,

Ltd.'s preparation workshop project

|

Source: Company reports & CCM

The article comes from China Fluoride Materials Monthly Report, 1605.

For more information about fluoride in China, go to CCM's Online Platform.

About CCM:

CCM is the

leading market intelligence provider for China's agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a range

of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.