Recently, Chinese feed enterprises have been entering into pig

farming, encouraged by environmental policies and the huge profit margins

in selling pigs and pork. Meantime, this may change the market risk and the

client area of the corn deep-processing industry in China.

Pig farming is becoming

popular among feed enterprises in China's feed industry.

On 1 Feb., 2016, Beijing

Dabeinong Technology Group Co., Ltd. announced that it will invest in four

projects during 2016, of which three are live pig industrial chain investments,

totaling USD24.41 million (RMB160 million). It will build up a comprehensive

industrial chain from boar breeding to commercial pig selling, and will

establish a farm which can hold 20,000 sows in 2016.

On 17 Feb., 2016, New Hope

Liuhe Co., Ltd. announced to invest USD1.34 billion (RMB8.8 billion) to farm 10

million live pigs in a project that has been described as "company +

family farm" within 3-5 years. It also plans to acquire 70% of Yangling

Besun Agricultural Industry Group Corporation Limited, a large pig farming

enterprise in Southwest China, aiming to establish a pig farming industrial

chain in this area.

Early in 2015, COFCO

Corporation, Chia Tai Group, Guangdong Wens Food Group Co., Ltd., Henan Chuying

Agro-Pastoral Co., Ltd., Muyuan Foodstuff Co., Ltd. and some large listed

farming enterprises announced to invest in building live pig farming projects.

Data shows that there were

35 large pig farming projects, with an accumulative investment of USD4.58 million

(RMB30 million) in China. The total investment exceeded USD10.68 billion (RMB70

billion) and 30 million of live pigs were sold.

There are two factors that

are driving Chinese feed enterprises into pig farming.

1. At present, China is

closing down small pig farms with annual sales of less than 500 pigs in order

to protect water quality at water sources. Also, the government is implementing

the most stringent pig farm relocation policy ever in Yangtze River Delta,

Pearl River Delta, Poyang Lake and Dongting Lake regions. In 2015, China

reduced over 30 million of pigs for sale due to environmental problems, among

which 3.95 million were reduced in Fujian Province. As a result of these

policies, small pig farms are forced to exit the market, leaving a sufficient

market gap for large enterprises to fill.

Small pig farms are being removed in China

Source: Xinhuanet.com

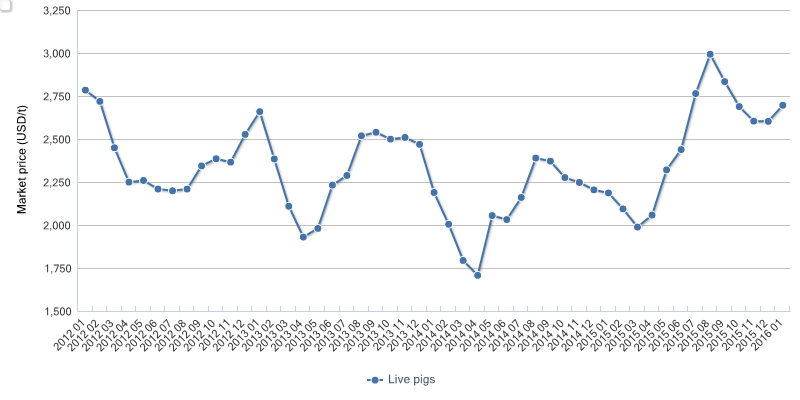

2. 2015 was the most

profitable year for China's pig farmers in the past five years. The price of

pork hit a record high for the most recent five years due to supply shortages.

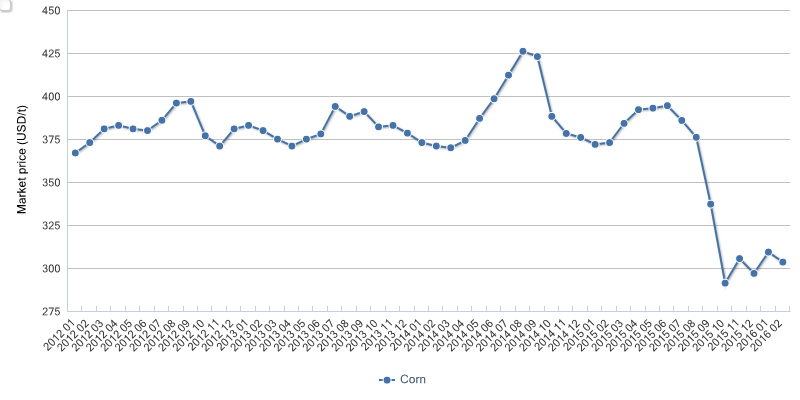

At the same time, the price of corn, the major raw material of feed, also hit a

five-year low. The huge profit margin attracted a large number of investors.

Furthermore, since the Chinese government is likely to reduce its interventions

on the corn price in the future, the corn price might further decline. This

means that the costs of raw material and feed additives may reduce.

Market price of live pig in China, Jan. 2012-Jan. 2016

Source: CCM

Market price of corn in China, Jan. 2012-Feb. 2016

Source: CCM

The large-scale pig

farming will change China's corn deep-processing industry in two ways.

1. China's pig farming is

currently based on small farms. Additionally, farmers differ greatly in pre-judging

and controlling the market information, which results in largely fluctuating

numbers of pigs in different farms. Large-scale pig farming can be much easier

for the government to manage. Also, a stable farming scale is very important to

the corn and amino acid market because the steady demand can greatly reduce the

market risks.

Feed enterprises are

important downstream clients for corn products. As a result, feed enterprises

that raise pigs can create collaborative development for both the feed and corn

product industries. In 2015, the reduced number of live pigs in farms weakened

the demand for feed, DDGS, lysine, threonine, corn gluten meal and other feed

products. Their sales prices even declined to the production costs, which made

these products unprofitable.

2. The client area of the

corn deep-processing industry may change. China's pig farming will gradually

transfer from South China to North China. Therefore, feed enterprises are

likely to relocate to North China to be closer to their clients and the

production area of raw materials. As for corn deep-processing enterprises, the

different client area will also create logistics costs and cause changes to

inventory plans.

About CCM:

CCM is the leading market

intelligence provider for China's agriculture, chemicals, food &

ingredients and life science markets. Founded in 2001, CCM offers a range of

data and content solutions, from price and trade data to industry newsletters

and customized market research reports. Our clients include Monsanto, DuPont,

Shell, Bayer, and Syngenta.

For more information about

CCM, please visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.

Tag: feed, pig farming, corn