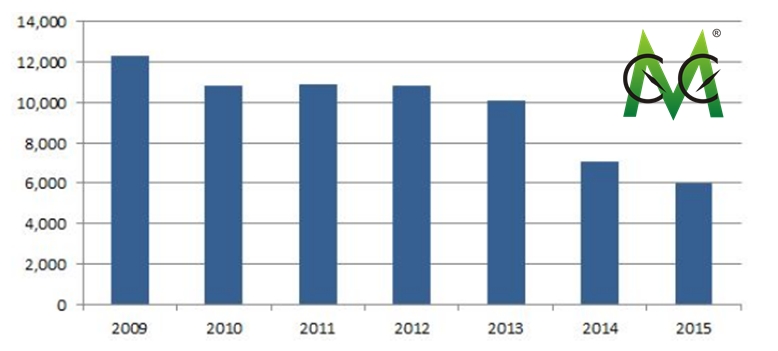

Due to the intensive production, massive imported meats and strengthened industry supervision, large amount of small feed manufacturers withdrew from the market, so the total number of Chinese feed manufacturers is decreasing year by year according to CCM.

In 2015, the number of feed processing enterprises fell to around 6,000 compared with 7,000 in 2014, 10,113 in 2013 and 10,858 in 2012, revealed by Ma Youxiang, Director from Department of Animal Husbandry of Ministry of Agriculture of the People's Republic of China (MOA). The decreasing number of feed enterprises was affected by the following factors:

Intensive production

With the development of feed industry in recent years, the domestic feed industry is gradually transforming from extensive mode to intensive mode. Those with unqualified production technology, inferior quality, poor after-sales service and low brand awareness will be gradually replaced and eliminated.

Massive imported meat

In 2015, China imported about 1.2 million of pork (including fresh meat: 700,000 tonnes and chop suey: 500,000 tonnes). The domestic pig farming industry is still at a low level and the farming cost is high, which result in higher domestic pig price than the international. In the same year, China's import volume of beef and mutton respectively exceeded 600,000 tonnes, because foreign semi-grazing farming model excels in cost over Chinese captive farming model. Massive imported meat not only has certain impact on the domestic meat market, but also drives those farmers who bear high production cost, low efficiency and household farming mode to withdraw from the market. In 2015, about 5 million farmers mainly small- and medium- sized farmers exited the market. Among them, many small feed factories who target family farmers suffered great losses as well and exited the market.

Transformation of sales mode

In the past, feed industry reaped staggering profits. However, influenced by increasing number of competitions and industrial adjustment, feed manufacturers suffer a drastic fall in profit. In particular, direct sale and online sale models have currently become a trend in feed industry. Several manufacturers are gradually eliminated, as they are unable to transform sales modes and adapt to the market changes.

Ever-increasing brand awareness

Nowadays, over 70% of domestic consumers have obvious brand preference, because most of them believe that a branded product has guarantees in quality, price and after-sales service. After a purchasing habit formed, they won’t consider to change other brands unless product problem. There is rising brand awareness among Chinese consumers, "products without labeling of manufacturer name, or date of production, or certification" will be eliminated first. Then comes the non-brand products and small brand products.

Blind expansion

Chinese entrepreneurs have a tendency to set foot in other fields after they achieved a leading position in a certain industry. For example, one made great success in feed industry, and then it attempts to invest a lot in real estate when that industry is thriving. Later, it even regards the investment of real estate as major business while feeds industry as avocation. That is why it is difficult for feed industry to recover when it faces various shocks.

Gradually strengthened industry supervision

On 5 Jan., 2015, it was stated on the website of MOA that it strictly carried out the new entry thresholds to eliminate unqualified enterprises, after the implementation of newly revised Feed and Feed Additive Regulations starting from 1 May, 2012. As the rigidity of regulation and supervision is improved, those small-scale feed factories which are unable to obtain production certificate or cannot pass the inspections are forced to exit the market.

Number of registered feed processing enterprises in China, 2009-2015

Source: MOA

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: feed