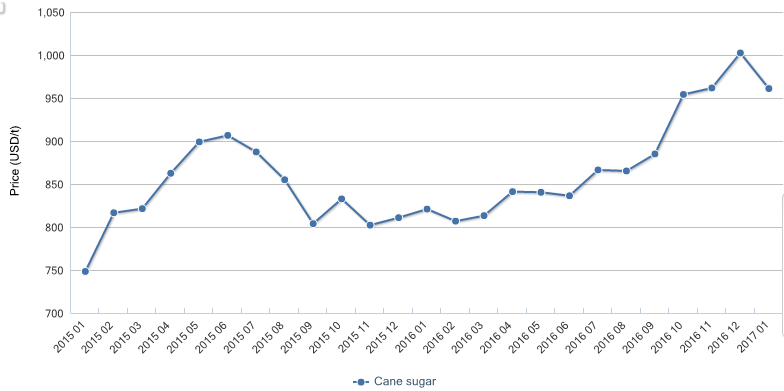

After

an almost constantly growth of the sugar price in China since the beginning of

2016, the first month of 2017 has already shown a decline of the cane sugar

price in China, back to the level of November 2016. Market intelligence firm CCM has spoken with insiders of the industry to reveal the reasons behind the

price decline and predict the development of the sugar price in the near

future.

China's

monthly market price of cane sugar, Jan. 2015-Jan. 2017

Source:

CCM

In

the year 2016, China's sugar market experienced a rebound from the sluggish

trend in 2015, with almost seamless growth till December. During the last year,

the planting area of sugarcane did decrease. This causes a higher purchase cost

for the sugar producers, due to shorter supply. Additionally, some heavy rain

during that time also reduced the quality of sugarcane, increasing the cost of

sugar manufacturing ones more. This led to rising sugar prices throughout the

year.

However,

In the first month of 2017, China's sugar market already faced a decline in

price. According to the industry expert, the reason can be found in the

weakened impact by financial features and a changing supply-demand relation.

The macroeconomic conditions, which back this statement up, can be summed up in

three main factors for China and some developments in the USA.

Macroeconomic

conditions

China's

government is following a more neutral monetary policy in the year 2017. That

concludes the monetary policy will rather turn to be normal instead of being

loose. In addition, there are no critical comments about a rational economic

operation, which shows a more tolerate attitude towards slower economic growth.

Finally, a prevention and control policy of financial risks is in the slow

transformation to a prevention only of financial risks.

Looking

at the USA, the Federal Reserve System is going to increase the USD interest

for about 3-4 times in the year 2017. This leads to the increase of the US

Dollar Index, which is very likely to even reach the historic high 121.02,

which the last time was reached in 2001. This development then will restrain

certain speculations of a bulk commodity.

The

development of the US Dollar Index is furthermore also affecting the Brazilian

currency, which continues to depreciated. The overall effect is reduced costs

for sugar exports from this important manufacturing country, with the outcome

of a likely shrinking sugar price at the global market.

Supply

of sugar

For

analysing the supply of sugar, it is useful to look at the largest markets for

sugar, namely China, India, and Brazil.

According

to the industry expert, the sugar output in China will continue to increase in

the season 2016/17, due to an enlarging planting area for sugar production in

China's most important province and an increased output of sugar beet in the

critical provinces. The climate condition for sugar production also shows a

beneficial development for this extracting season.

In

numbers, the nationwide sugar output in China is expected to rise about 800,000

tonnes. With an outlook of the further increase of sugar yields, the increasing

output will without any doubt put a growing pressure on a price rise in China.

India

used to be a big sugar importer, due to the growing demand in this country. In

the extracting season of 2016/17 however, India shows its sugar output

surpassing its demand by 5.60 million tonnes. Hence, India does not depend on

sugar imports in the short run, which is dramatically changing the global

supply and demand situation of sugar.

For

Brazil, the output of sugar is expected to fall but still remain on a high

level. The total output for 2016/17 is expected to reach almost 40 million

tonnes, which is less than it has been forecasted in August 2016.

Factors

supporting price rise

A

lasting sugar price fall, however, is not very likely, looking at the

conditions in China, which support a price rise in general, even it is slight.

According

to CCM's research, the Ministry of Commerce of the People's Republic of China

is discussing a tariff increase of imported sugar, which is very likely to be

implemented. This will generate greater pressure on exporters to China and is

beneficial for a domestic price rose in China.

Also,

China's government is successful fighting against the sugar smuggling in the

country, with a decreasing amount of sugar smuggled at a result, which supports

Chinese manufacturers to keep their prices high.

About

CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the sweeteners market in China? Try

our Newsletters and Industrial Reports or join our professional online

platform today and get insights in Reports, Newsletter, and Market Data at

one place.

For

more trade information of sugar, including Import and Export analysis as well

as Manufacturer to Buyer Tracking, contact our experts in trade

analysis to get your answers today.

Looking

for a convenient way to get comprehensive and actual information as well as a

platform to discuss with peers about the latest sugar and sweeteners

industry and market trends? Simply subscribe to our YouTube

Channel and join our group on Facebook.