Summary: In 2015, the prices of stevia

sweeteners declined constantly in China, mainly due to the sufficient supply of

raw material and the follow-up price adjustment by stevia sweetener producers.

As a whole, however, the market is still prospective this year, thanks to the

increased demand from Europe and America.

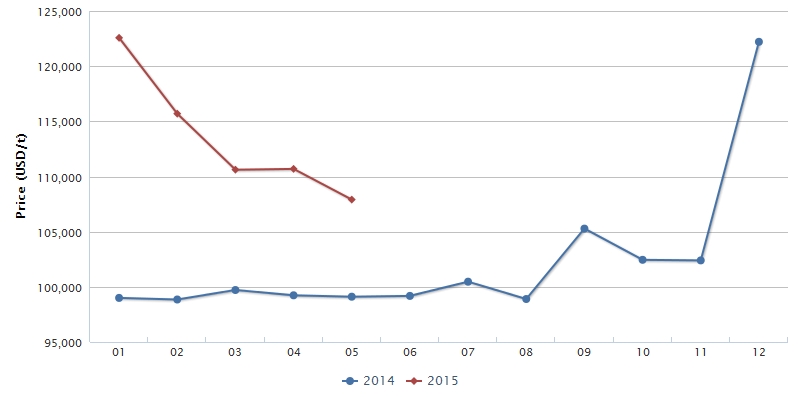

In 2015, the prices of stevia sweeteners

constantly declined in China. In June, the ex-works price of stevia sweetener

(RA95%) was USD106,197/t (RMB650,000/t), down by 10% over that of USD122,569/t

(RMB720,000/t) in January. This is mainly because with a sufficient supply of

raw material, the producers gradually adjusted the prices to meet the client

enquiry.

Ex-works price of China's stevia sweetener

(RA95%), January 2014-May 2015

Source: CCM

In 2015, the planting area of stevia leaf

(centred in Gansu, Heilongjiang, Anhui provinces, Jiangxi Zhuang Autonomous

Region, etc.) is estimated to reach around 10,000 ha (150,000 mu), a large rise

over that of 3,333 ha (50,000 mu) in 2014. This, of course, guarantees the

supply of raw material to the stevia sweetener enterprises.

In 2014, the short supply of stevia leaf in

the market led to the insufficient raw material for enterprises to produce

stevia sweeteners, which then propelled enterprises to up-regulate the price of

stevia sweetener (RA95%), from USD99,000/t (RMB600,000/t) in January to

USD122,211/t (RMB750,000/t) in December. Such a skyrocketed price caused

discontent amongst downstream clients.

Now the price of stevia sweetener (RA95%)

still stays very high, however expected to continue declining when large

quantities of stevia leaves are put onto the market during June-September.

"If the ex-works price is between USD99,000/t (RMB600,000/t) and

USD106,197/t (RMB650,000/t), it is in a rational range", said an industry

insider.

Despite the price declines, the stevia

sweetener market, as a whole, shows a bright prospect. This can be ascribed to

the increased demand from the downstream markets in Europe and America. In

2014, both Coca-Cola Company (in the US) and PepsiCo Inc. (in the US) launched

the stevia sweetener-enriched carbonated beverages onto the market. From then

on, the enterprises throughout the world, especially from Europe and America

have constantly put the-like new products onto the market, such as candy,

beverage, biscuit and children's toothpaste. It is predicted that the global

sales of stevia sweeteners will exceed USD500 million in 2015, up by over 5%

YoY.

Under such a circumstance, Ganzhou Julong

High-Tech Industrial Co., Ltd. (Julong High-Tech) also intended to again join

in the market competition. In H1 2015, Julong High-Tech increased the input

into environmental protection and halted production for equipment

reconstruction, expected to restart production this year.

Julong High-Tech was ever one of the

leading stevia sweetener enterprises in China, capacity given at 4,000 t/a. In

2011, many domestic enterprises expanded the production capacity, resulting in

oversupply and sluggish market. Due to the simple product mix (only stevia

sweeteners), Julong High-Tech presented poor risk resistance and thus

encountered capital chain interruption. In June 2013, Julong High-Tech finished

the equity reorganisation, from which the debtees holding USD99.67 million

(RMB610 million) were transferred into shareholders. After 2-year development,

as of February 2015, the bank loans and accounts payable were reduced by about

USD17.97 million (RMB110 million) in total.

About CCM:

CCM is the

leading market intelligence provider for China's agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to industry

newsletters and customized market research reports. Our clients include Monsanto,

DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more

information about CCM, please visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.