In 2016, the market price of palm oil keeps climbing up for 5 consecutive

months in China. According to CCM's price monitoring, the average market price

of palm oil (24°) is USD881.68/t (RMB5,692.56/t) in May 2016, a MoM rise of

1.11% and a YoY rise of 8.87%.

Market price of palm oil (24°) in China, Jan.-May 2016

Source: CCM

As the domestic supply and demand remains stable recently, the rising market

price of palm oil is mainly affected by the following external factors:

- The yield reduction in producing area of palm oil

The first quarter of a year is the traditional slack season for palm oil

production. Coupled with the influence of the El Nino phenomenon, the dry

weather affected the yield in producing area. "The El Nino phenomenon

reduces the global output of palm oil by over 2 million tonnes in 2016,"

said James Fry, president of LMC International at the Palm Oil Industry

Conference held in Kuala Lumpur in Feb. 2016. Therefore, the sliding yield

stimulates the domestic market price to go up.

- The mounting price of competing product – soybean oil

According to CCM's price monitoring, the market price of soybean oil also

continues rising for 5 consecutive months in China in 2016. In April, the

average price of soybean oil (first grade) at port was USD992/t (RMB6,407/t),

up by 5.99% MoM.

China's palm oil relies on import. The import volume of palm oil is also

increasing in 2016. China's imported palm oil mainly includes palm stearin (HS

code: 15119020) and palm olein (customs code: 5119010). In Q1 2016, the import

volume of palm oil was about 1.15 million tonnes, up by 20.60% YoY.

Notably, China mainly imports palm oil from Malaysia and Indonesia. In 2015,

57% and 43% of palm oil was mainly imported from Indonesia and Malaysia

respectively (total import volume: 5.89 million tonnes). The import price was

USD538.94/t in Q1 2015, a MoM rise of 2.8%.

Due to the rising palm oil price, the price gap between palm oil and corn oil

is narrowing. China's palm oil is widely applied in the food industry, which is

a direct competing product for corn oil. When the market price of palm oil

keeps rising, that of corn oil continues falling.

In May 2016, the average

market price of corn oil (first grade) is USD1,308.35/t (RMB8,447.61/t), down

by 2.5% MoM and 1.86% YoY. The price gap between palm oil (24°) and corn

oil (first grade) narrows to USD426.67/t vs. USD784.93/t in Dec. 2015. Thanks

to this, corn oil enjoys increasing price advantage and it will grab some

market shares of palm oil.

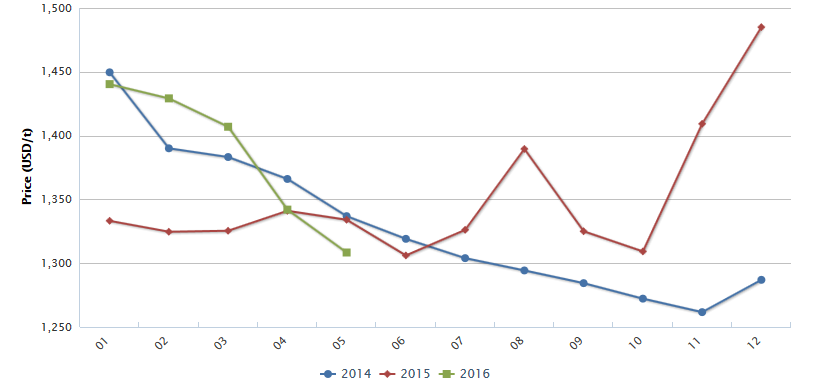

Market price of corn oil (first grade) in China, Jan. 2014-May 2016

Source: CCM

Price gap between palm oil (24°) and corn oil (first grade) in China, Jan.

2015-May 2016

Source: CCM

The effect of the El Nino phenomenon on palm oil production often lags. After

calculation based on the experience of previous years, the effect of the El

Nino phenomenon will hit a peak in Aug. 2016. Since the third quarter of a year

is the busy season for palm oil production, the yield is predicted to be

greatly impacted by the El Nino phenomenon this year.

In addition, it is very

likely that the La Nina phenomenon after the El Nino phenomenon will bring

rainstorm to the producing area of palm oil, reducing the yield further.

Therefore, China's market price of palm oil will keep increasing in the future.

At that time, the price gap between it and corn oil will further narrow because

it is not very likely for corn oil price to rebound in the coming future, which

provides a greater opportunity for corn oil to seize market shares.

This

article comes from Corn Products China News 1605, CCM

About

CCM:

CCM is the leading market

intelligence provider for China's agriculture, chemicals, food &

ingredients and life science markets. Founded in 2001, CCM

offers a range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients include

Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about

CCM, please visit www.cnchemicals.com or get in touch with

us directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: oil corn