China's major large-scale capacity expansion projects on citric acid progress

slowly affected by low price of citric acid and bad financial condition of

manufacturers.

In 2015, China mainly has 3 projects for capacity expansion on citric acid.

However, they all progress slowly.

-

Shandong Juxian Hongde Citric Acid Co., Ltd. (Juxian Hongde): 100,000 t/a citric acid project - since H2 2013, the factory was

started to be built and completed in 2014; affected by the low price of citric

acid, now the project progresses very slowly

-

RZBC Group: 100,000 t/a citric acid

project - the company stated to invest EUR99.55 million in building this

project in Hungary on 2 Sept., 2014 but the project is still under construction

now

-

Anhui BBCA Biochemical Co., Ltd.: 60,000

t/a citric acid project - the company started to build the factory in Szolnok

Industrial Park, Hungary on 9 Sept., 2014 but the project is still under

construction now

It is known that the slow progress of these citric acid projects is mainly

attributed to the low market price of citric acid.

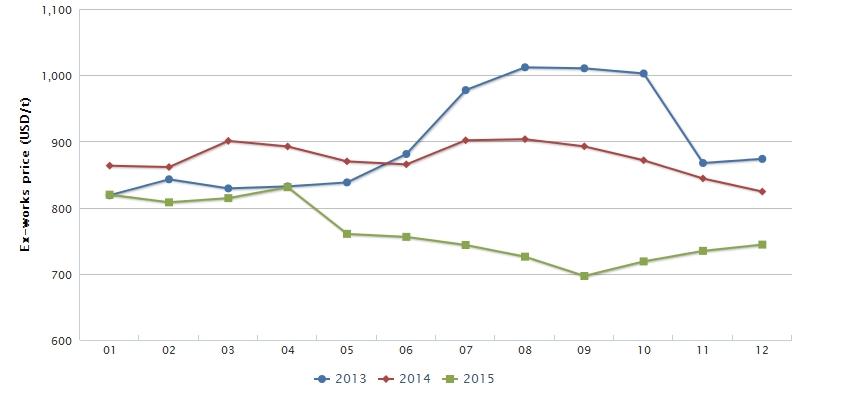

According to CCM research, in 2015, the average ex-works price of monohydrate

citric acid is lower than that in the same period of 2014. In Dec., the average

ex-works price is USD744.06/t (RMB4,760/t), down 9.72% year on year. That the

price stays at low level for a long time reduces most of manufacturers'

performance. Some of them even suffer from losses. The poor financial condition

of manufacturers affects the progress of projects. Meantime, the too low

product price also influences manufacturers' enthusiasm to put project into

production.

China's ex-works price of monohydrate

citric acid in Jan. 2013-Dec. 2015

Source: CCM

Different from Juxian Hongde, other two enterprises choose to set up projects

overseas, aiming to reduce the negative impact from anti-dumping.

About 80% of China's citric acid is exported. As the export volume is

increasing, and the export price is low, China's citric acid suffers from

anti-dumping investigation from overseas for many times. In recent years, the

US, Thailand, Ukraine, South Africa and the European Union (EU) have conducted

anti-dumping investigation on China's citric acid. This poses a great influence

on the export of Chinese enterprises. At the same time, the chain reaction of

trade friction increases the risk of China's citric acid export market.

Therefore, building projects abroad is a smart choice.

Notably, that the two enterprises decided to factories in Hungary can

comprehensively solve the tariff problems in the EU market. Hungary is located

in the middle of Europe. Affected by the anti-dumping issues, China's price of

citric acid exported to EU countries is much higher than that to other

countries, which significantly reduces its competitiveness in local markets.

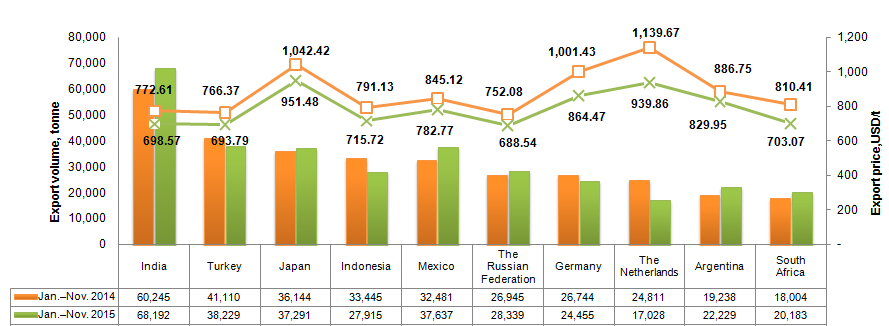

According to CCM, in Jan.-Nov. 2015, China exported 24,455 tonnes of citric

acid to the Germany, the largest export destination in EU, with the price

averaged USD864.47/t. In the same period, the average export price of China's

citric acid to India, the largest export destination was USD698.57/t.

China's export destinations of citric acid in 2014-2015 (Jan.-Nov.)

Source: China Customs

According to CCM's price monitoring, in recent four months, China's ex-works

price of citric acid keeps rising. The price in Dec. is increased by 6.80%

compared to USD696.68/t (the lowest of recent 8 years) in Sept., which is

supported by manufacturers. Pressured by serious loss, citric acid

manufacturers increase the ex-works price to ease the loss.

Currently, the price of corn (raw material of citric acid) is far lower than

that in 2014. Based on CCM's data, in Dec. 2015, the market price of corn was

USD297/t (RMB1,900/t) in China, down 19.07% year on year. The future market of

citric acid will be boosted to some extent under no signs of improvement in

demand, limited space of price rises, declining raw material price and the

coming busy season for export in Jan.

About CCM:

CCM is the leading

market intelligence provider for China's agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of

Kcomber Inc. More about CCM, please visit www.cnchemicals.com.

We will attend FIC in the coming week. If you would like to meet us for consultancy in FIC, please get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.