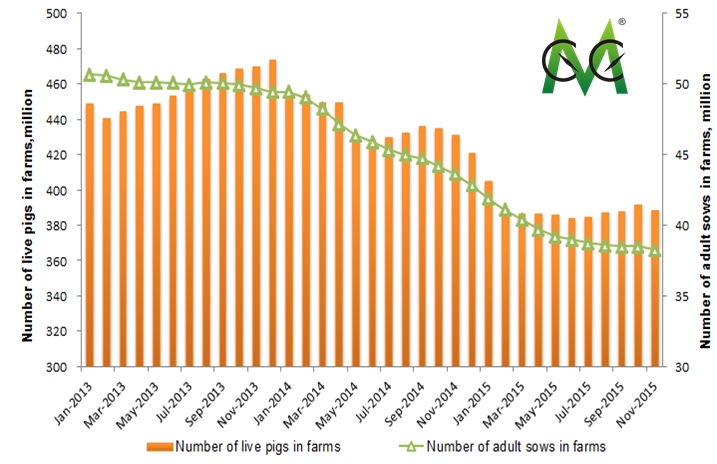

China's farming scale of live pigs is recovering at a slow speed under the fixed policy on capacity reduction and small number of adult sows in farms but continuously rising number of pigs that are ready for slaughter. CCM believes this will affect the destocking speed of corn in China.

Since H2 2015, China's pig farming has been recovering slowly. According to data released by the Ministry of Agriculture of the People's Republic of China (MOA), in Nov. 2015, the number of live pigs in farms reduced to 388.06 million, 2.74 million less than that in Oct.

There are two major reasons for the slow recovery of pig farming.

1. Policy restrains the recovery of pig farming

In consideration of water pollution and air pollution, China is closing down small-scale pig farms (annual number of pigs for sale<500) extensively. This has a wide impact on the pig farming since most of pig farms are small in China.

Take Fujian Province, a large pig farming province in coastal area as an example, data from Fujian Provincial Department of Environmental Protection show that, Fujian has closed down 30,900 pig farms in 2015, reducing 3.95 million of live pigs in farms.

At the same time, Chinese government issued the Guidance on Advancing the Adjustment and Optimization of the Pig Farming Layout of Southern Areas Crisscrossed with Rivers on 26 Nov., 2015 so as to ensure the water safety of southern areas crisscrossed with rivers which are the major water sources of the South-to-North Water Diversion Project. The guidance pointed out that the scale of pig farming should be scientifically reduced based on the actual land bearing capability of each region.

In addition, the southern areas crisscrossed with rivers mentioned above refer to 10 cities/provinces including Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan and Guangdong. Meantime, Chinese government issued the Guidance on Advancing the Adjustment and Optimization of the Pig Farming Layout of Southern Areas Crisscrossed with Rivers on 26 Nov., 2015 so as to ensure the water safety of southern areas crisscrossed with rivers which are the major water sources of the South-to-North Water Diversion Project. The guidance pointed out that the scale of pig farming should be scientifically reduced based on the actual land bearing capability of each region. In addition, the southern areas crisscrossed with rivers mentioned above refer to 10 cities/provinces including Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan and Guangdong.

2. Number of adult sows in farms remains at low level

Now the number of adult sows in farms remains at low level since China has reduced the pig farming scale significantly. In Nov., the number was 38.25 million, a MoM fall of 0.6% and a YoY fall of 12.4%, according to the MOA.

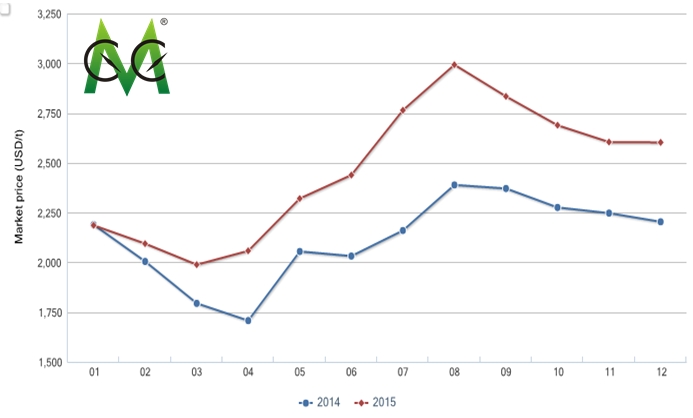

Meantime, the price of live pigs has started to fall after reaching a peak in Aug. 2015. Farmers have a strong will to sell their pigs to ensure the profitability. According to analysts CCM, in Dec. 2015, the average market price of live pigs was USD2,603.60/t (RMB16,929/t), dropping by 7.54% over USD2,993.35/t (RMB18,310/t) in Aug.

Number of live pigs in farms and adult sows in farms in China, Jan. 2013-Nov. 2015

Source: MOA

The slowly recovering pig farming goes against the destocking of corn.

Most of China's corn is used to produce feeds especially pig feeds. The slowly recovered pig farming will slow down the corn destocking in China.

In 2014/15, China's total consumption volume of corn was about 189 million tonnes, up 0.48% year on year, according to China Feed Industry Association. Of this, 115 million tonnes of corn was used to produce feeds, among which about 50% was used to produce pig feeds.

In addition, that Chinese government reduced the small-scale pig farms in southern areas increases the market space of live pig supply. Many large enterprises are attracted to build up large pig farming projects in North and Southwest China.

However, it takes a certain time for these projects to be put into production. So, the recovery speed of China's pig farming is still limited, which may slow down the destocking of corn.

FIGURE: China's market price of live pigs in Jan. 2014-Dec. 2015

Source: CCM

If you need more information about corn in China, why not get a free-trial of CCM's Online Platform? You can get much more information about the whole corn market for FREE!

Access to CCM's entire resources, literally

Over 180,000 reports, news, data

Across over 15 segment industries

GET FREE TRIAL NOW!

About CCM:

CCM is the leading market intelligence provider for China's agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: corn, pig farming