Amidst the economic setback, the increase in the production of sugary food also slowed down. CCM believes that this means weakened demand for sweeteners, a drawback in the industry development.

According to the National Bureau of Statistics, during January-September 2015, the production of 6 selected sugary food, including candy, canned food, frozen drinks, quick-frozen rice and noodle products and carbonated beverages, increased YoY. However, the growth rate slowed down. For instance, the output of candy reached around 2.53 million tonnes, up by 7% YoY (vs. 24% YoY in the same period of 2014).

Currently, sucrose (cane sugar + beet sugar, 90% of cane sugar) plays a leading role in China's sweetener market, supplemented by starch sugar, sugar alcohol, high intensity sweeteners (HIS), etc. The slowdown in the production growth rate indicates the setback in the demand for sweeteners. Then, what will happen in the domestic sweetener market?

"The competition between sucrose and starch sugar will be intensified', an industry insider commented to CCM.

Now the sucrose price as a whole shows an upward trend, whilst the starch sugar price continues decrease, which leads to the price gap of nearly USD475/t (RMB3,000/t). Under the circumstance that the development in the sugary food industry slows down, producers probably will substitute starch sugar for sucrose. Take the production of 1 bottle of cola (500 ml) for example:

- White sugar

- F55 high fructose corn syrup (HFCS)

As the full cost from producing 1 bottle of cola is USD0.22-0.24/bottle (RMB1.4-1.5/bottle), the cost from using white sugar accounts for 20%. Comparatively, that from using F55 HFCS makes up for only 10%.

In fact, the upsurge that starch sugar was used to substitute sucrose emerged in 2011. Take HFCS for example. In 2011, the price of sucrose was up to USD1,140/t (RMB7,200/t), whilst the price of HFCS was about USD608/t (RMB3,840/t), over USD475/t (RMB3,000/t) price gap. This propelled most of the beverage producers to use HFCS instead, especially the carbonated beverage producers such as The Coca-Cola Company (Coca-Cola), PepsiCo Inc. (PepsiCo), Sprite (under Coca-Cola) and Dr Pepper/Seven Up, Inc. Specifically, Coca-Cola and PepsiCo have already applied HFCS to replace 80% of white sugar in their production.

How about the potential market for starch sugar to substitute for sucrose? Still take HFCS for example.

According to statistics from the China Starch Industry Association, China produced around 3.3 million tonnes of HFCS in 2015, up by 10% or so compared to that of 2.1-2.2 million tonnes in 2014. This occupied 40% of the total starch sugar production. As the largest downstream market for HFCS in China, the beverage industry every year consumes 75% of the total. "The carbonated beverage segment plays an important role in consuming HFCS. Since 2011, its demand for HFCS has been saturated basically – nearly 70% of sucrose has been replaced', according to an industry source.

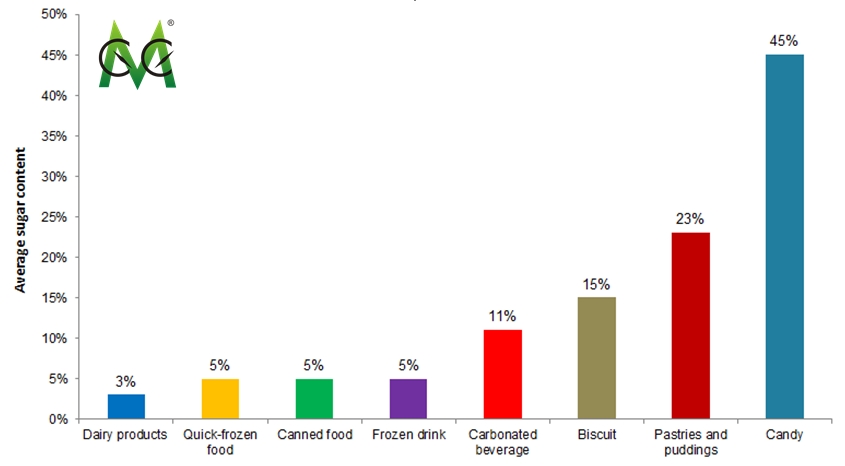

In addition, the segments including candy, biscuit and pastries and puddings, are expected to be involved in the competition between starch sugar and sucrose in the future, since the sugar contents in them are fairly high, at 45% (candy), 15% (biscuit) and 23% (pastries and puddings) respectively. That is to say, the price of sucrose also impacts their production costs. For instance, the cost of white sugar takes up around 70% of the cost mix in producing hard candy.

When the price of sucrose continues increasing, the pressure on such producers will be enlarged significantly. Under such circumstances, the producers may choose to use starch sugar. According to wugu.com (a news platform for agricultural produce), the consumption of sweeteners from candy, biscuit and pastries and puddings reached 2.2 million tonnes, 2.2 million tonnes and 1.5 million tonnes respectively. Of this, white sugar held about 70%, 80% and 60%.

"The market size of starch sugar in the food industry is about 17%, expected to reach 25% in the next five years', estimated by an industry insider: "However, in the short run, mainly small- and medium-sized enterprises are more likely to use starch sugar instead of sucrose, since they care much about production costs'. Some food & beverage enterprises stated that the substitution would need changing the formula and would impact the taste. So, "in the short term, we would like to apply starch sugar in new products'.

Certainly, the role of sugar alcohol and HIS cannot be ignored, either. As people incline to the healthy (low-sugar) consumption, those sweeteners which cannot be absorbed by human body will have relatively good prospect. Take HIS for example. In 2014, its consumption exceeded 34,000 tonnes, up by 9% YoY. Its main downstream markets are dry fruit, nut and conserves, of which the consumption accounted for around 40% of the total.

Now sugar free mints also become an important downstream for HIS and sugar alcohol. In China, nearly 2% of mints are sugar free. Compared to that of 90%+ in developed countries, China boasts a broad market.

Average sugar content of selected sugary food in China

Source: CCM

Sugar free mints