CPhI

China 2017 is China’s largest exhibition about the pharmaceutical and health

care industry. The exhibition will be held for the 17th time in Shanghai

from June 20 to 22. The organisers are expecting the biggest representatives of

Chinese and international pharmaceutical ingredients players from more than 120

countries. Suppliers, distributors, and buyers will gather at one place to connect

and discuss the trend of China’s health care market.

This

year’s exhibition is going to be divided into different zones, including active

pharmaceutical ingredients, fine chemicals and intermediate suppliers,

biopharmaceuticals suppliers, animal health products, natural extracts

products, finished dosage suppliers, excipients suppliers, and nutraceuticals.

Some

of the leading Chinese enterprises which take part in the exhibition are the

Yangtze River Pharmaceutical Group, North China Pharmaceutical, the CSPC

Pharmaceutical Group, Qilu Pharmaceuticals, and Jiangsu Hengrui Medicine.

Market

intelligence firm CCM, a provider of data, information, and analysis about

China’s healthcare and pharmaceuticals industry, gives an overview about the

mentioned industries in China as well as the biggest news on Amino Acids and

Vitamins trends as well as manufacturers' performance.

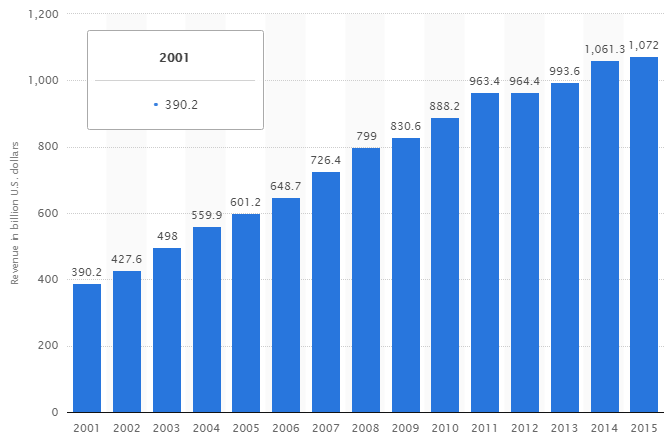

Global pharmaceuticals

industry

China’s pharmaceuticals industry is one of the largest worldwide. That’s why the

exhibition deserves a lot of attention to be part of the exciting trend this

industry is going through at the moment. Back in the year 2014, the worldwide

pharmaceutical industry has generated revenue worth more than USD1 trillion.

While North America has the largest share in the global pharmaceutical

industry, China’s pharmaceutical sector is showing the highest growth rate

worldwide.

Source: Statista

The

spine of the pharmaceutical industry is the research and development

department. After all, the share of costs in pharmaceutical company’s R&D

can make up to 20% of the total costs.

According

to consulting giant PWC, the major trends of the pharmaceutical industry are

reshaping the market significantly in the near future. The most important

trends with the most impact are the increase of chronic diseases, washed

boundaries of traditional healthcare, surging demand in developing countries,

and switching focus of governments from treatment to prevention.

The

challenges companies in the pharmaceutical industry are facing nowadays are

rising customer expectations and poor scientific productivity. After all,

customers demand on healthcare products is growing in the background of

environmental friendly production and efficiency of drugs and other products.

Also, while the output of new products has been remaining on the same level in

the last years, the research and development methods do not really change

significantly, which doesn’t give much hope for a boost anytime soon.

China’s pharmaceuticals

industry

China

has the largest population worldwide and needs to ensure healthcare and a

stable pharmaceuticals industry. Hence, the country has reached the second

largest pharma market. After all, China is responsible for about 40% of the

global API production. And still, the government is further investing in this

sector to ensure growth and innovation.

The

main advantages for the pharmaceuticals industry in China are the comparable

low production costs while quality remains good.

While

China’s wealthy middle class is growing, the average Chinese is getting older,

and the access to healthcare is improved continuously, China’s pharmaceuticals

and healthcare market is developing to a promising field for foreign investors

and players in this business.

Besides

the growing wealth for China’s population, the demand for healthcare products

and drugs is increasing seamlessly. One of the key drivers for this trend can

be found in the rise of chronical diseases, caused by significant air and water

pollution in China, which is responsible for the higher appearance of diseases

like cancer, heart diseases and other chronic conditions. According to some

research, China’s number of new cancer cases in 2015 was reported to have

reached over 4 million. Furthermore, As China’s population is growing older, by

2020 already 170 million elders beyond 65 years old will demand a tremendous

amount of health care products and services.

Exports to China

The

largest exporting country for pharmaceutical and healthcare products to China

is the USA, which is also the biggest producer.

However,

the export situation for foreign traders is not easily in China. Domestic

manufacturers are enjoying the strong benefit, that they are allowed to sell

their products to the consumers directly. Foreign exports on the other side are

facing a complex distributing system, where they are requested to sell their

products via local distributors in China. Furthermore, mark ups in the supply chain

increase the costs and therefore the final price of imported products.

The

lack of transparency, combined with cheap Chinese counterfeit medicines and

price controls are still keeping up barriers for overseas importers to China.

It

is notable, that in China only about 20% of all drugs are patented and branded

medication. Even this number is rising enormously in the last years, it is

still a sign of China’s embracement for traditional Chinese medicine and

generic sales of drugs.

R&D

China

used to be a manufacturer of cheap and generic drugs with little efforts in

research and development of new drugs. Facing a low-income population, also

foreign traders were traditionally selling old and cheap drugs in China’s

market in the last decades. This situation is changing rapidly nowadays.

Foreign enterprises are selling their new and more expensive pharmaceutical

products to China’s expanding middle class, as also China’s manufacturers have

discovered the need for effective R&D.

Hence,

many scientists, who worked in advanced countries in Europe or the USA, coming

back to China and bring the knowledge to modernise domestic research and

development.

CCM: The trend of

China’s main pharmaceuticals production

Amino Acids

In

the past years, a slowdown in Chinese economic growth, serious overcapacity,

low prices, increasing burden from environmental protection and product

homogenization hinder the development of amino acid enterprises. They struggle

for development and make sweeping transformation and reform, in order to remain

competitive and profitable in the overall industry.

China’s

Amino Acids are undergoing a different trend in the first half of 2017. For

instance, methionine prices continued going down while the prices of threonine

remained strong. Lysine price was able to increase significantly in the first

half of 2017.

It

is worth mentioning, that several outbreaks of animal diseases are increasing

the awareness for healthy animal feed and further boosting the demand for amino

acids like methionine. Asia-Pacific is the leading market for methionine, with

huge populated countries like India and China, which growing middle classes are

thriving the need for meat, and hence methionine for the production of

feed. While the global annual growth rate for methionine demand has been

about 6% since the year 2013, China’s growth rate in demand is rising even

higher. After all, the demand is rising annually by about 7% up to 10%. The

L-methionine markets in China have been remaining stable in the first quarter

of 2017 but on a low level. The new production method, used by an increasing

number of manufacturers, namely the fermentation process, enables the

production of fewer costs. Hence, the demand will be higher for L-methionine

compared to the more expensive product DL-methionine.

Due

to the avian influenza outbreaks, not only affected livestock companies were

forced to limit or stop business, but also non-affected companies were ordered

by the government to reduce their business in order to avoid the spread of the

flu to humans. As a result of the production limitations, the prices of chicken

and eggs have dropped significantly in the last months. The low demand for the

feed then has reduced the price for methionine by almost USD 100 per tonne.

Another

factor with massive impact is a threat of methionine overcapacity in China. The

profitable methionine business in China and worldwide has led many

manufacturers to expand their production and install new projects. Hoping for

higher revenue out of the new product lines, the danger of methionine

oversupply is getting acute. Big enterprises like Shandong NHU and Bluestar

Adisso, and Evonik have announced production expansions, which may exceed the

growing demand for methionine.

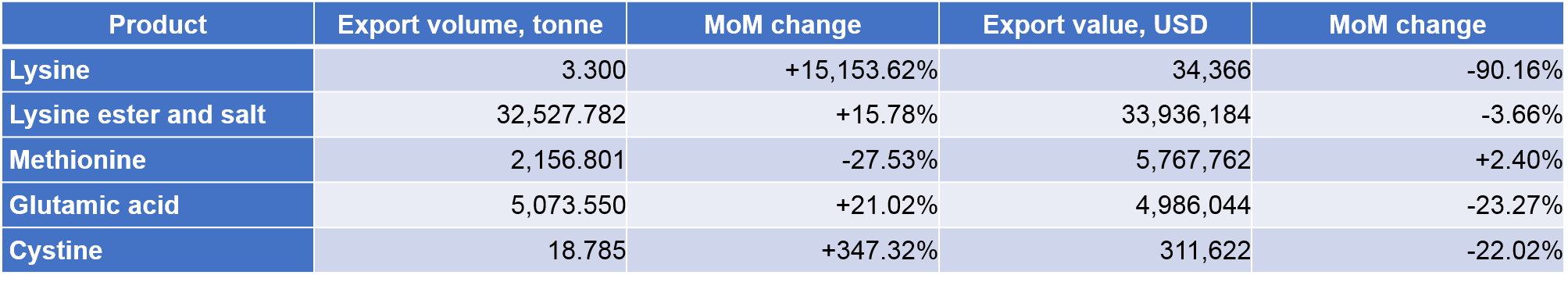

Import & Export

Trade

analysis firm Tranalysis shows the import and export volume of some major amino

acids in China for March 2017.

Source: Tranalysis and China Customs

Vitamins

China’s vitamins industry has developed rapidly in the past decade, becoming the

largest producer and exporter worldwide. However, since the output volume has

witnessed continuously growth while the value went down in the last years,

China’s vitamin business is losing profitability.

The

market situation is very monopolistic, as only a few enterprises are dominating

the production of certain vitamins. The leading vitamins manufacturers in China

are Hubei Guangji Pharmaceuticals and Zhejiang Tianxin Pharmaceuticals.

Furthermore, BASF and DSM are playing a huge role in this industry in China’s

and global markets.

In

the first half of 2017, most of China’s vitamins have seen significant rises in

price, which is mainly due to the strict environmental regulations ordered by

the government. As a fact, vitamins producer in China are always one

of the key targets for environmental inspections. According to CCM, in 2016 the

local governments have carried out inspections in 15 provinces of China. As the

supervision goes on in 2017, the supply of vitamins will remain tight.

In

late of April, the China Food and Drug Administration has released the On

Requesting Public Comment on Further Strengthening Supervision over Healthcare

Food. This paper is optimising the business process of manufacturers, as it

clears the definition of healthcare products, enhancing the regulations on

labels and advertisements, advances the filling work for new registrations,

standardises the approval process, and optimises procedures for technological

review. According to CCM, the consulting paper will save approval costs and

time for producers significantly.

In

the beginning of March 2017, the 9th National Pharmaceuticals Industry

Symposium took place, in which the mentioned price surges of pharmaceuticals

has been discussed. The API manufacturers were complaining about surging prices

and asked for new regulations to abandon the current monopolized situation of

China’s pharmaceuticals industry. Currently, API manufacturers need an API production

license, issued by the government, to be allowed entering the market in China.

In addition to that, so called Good Manufacturing Practice certificates are

needed as well. The problem is, that less enterprises are approved for these

licenses, which keep the number of manufacturers low and creates the

monopolistic situation.

This

system is demanded to be changed, to make it easier for new manufacturers to

get the permission of producing and selling pharmaceuticals, especially the

needed cheap drugs. To achieve this, API’s should be excluded from the national

drug management system and production guidelines could be implemented, which

ensure sufficient supply of pharmaceuticals.

The

market situation of vitamin E is a good example for the high monopolistic

situation, not only in China, but worldwide. For this vitamin, the four biggest

players account for more than 90% of the global supply. The enterprises are

Zhejiang Medicine, Zhejiang, NHU, Royal DSM, and BASF.

For

China, the price of vitamin E showed the beginning of a surge in March 2016,

after a depressing year in 2015. Insufficient supply of raw materials for

vitamin E boosted the price rise even more. The last price rise was made in

March 2017 by Zhejiang NHU, raising quotations by 30% again, according to CCM’s

price monitoring.

China

also inherits the largest vitamin B2 producer worldwide, namely Guangji

Pharmaceutical, who is accounting for global sales of 55%. The company has

increased prices several times in 2016, due to production suspensions and

marketing strategies. A report by the company states “We adheres to our

marketing strategy in controlling supply and increasing prices, and managed to

realise the optimum balance.”

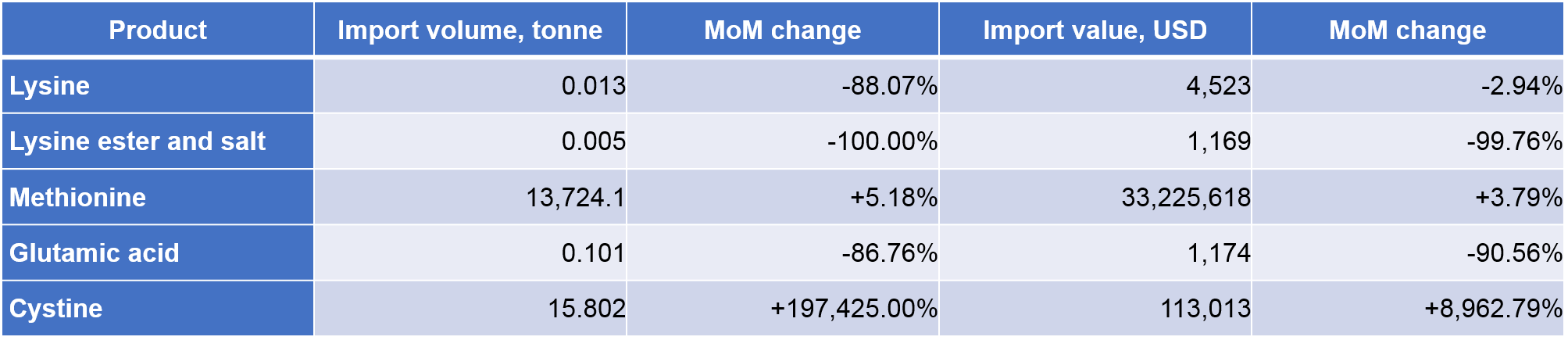

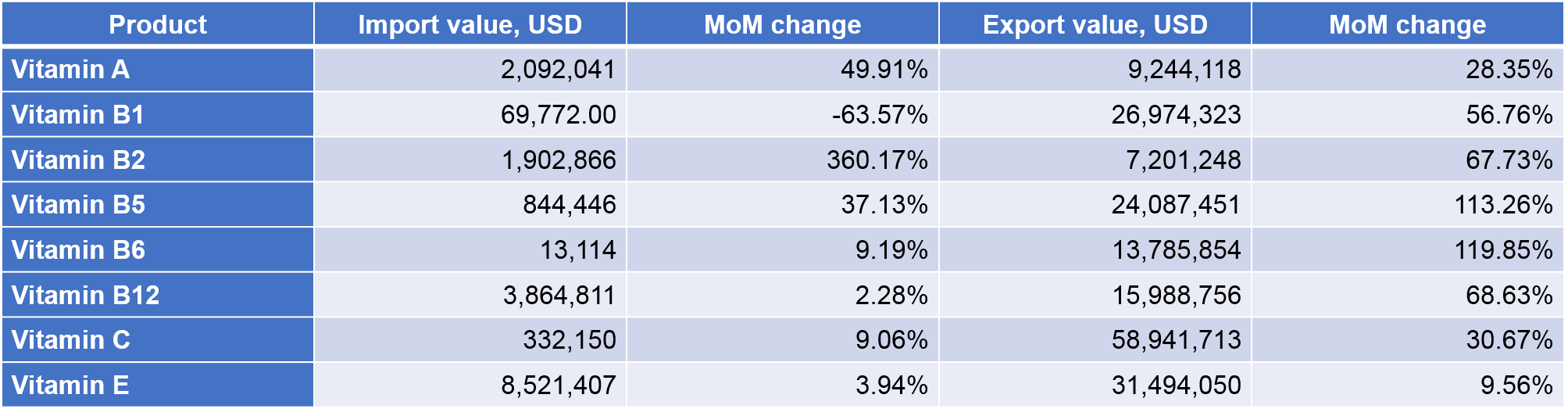

Import & Export

The

import and export trend for major vitamins in China in March 2017 are presented

by Tranalysis.

Source: Tranalysis and China Customs

Healthy beverages

The

busier lifestyle of China’s growing urban middle class is driving the market

for functional beverages because a rising number of workers don’t have the time

anymore for a healthy and balanced meal every day. The lacking energy and

nutrients are guaranteed nowadays by consuming functional beverages including

taurine and vitamins. Hence, an increasing number of enterprises discover China

as a promising market for functional beverages, launching new products into the

large market. One example is French food manufacturer Danone, which is

contributing a new vitamin beverage called Mi-PRD to traders in China. The main

benefits of the new product are taurine plant-extracted ingredients.

The

company hopes to increase the sales in China with the new product, since it was

facing weakening profitability in this market recently, with negative effects

on the financial numbers of the Mizone brand in 2016. According to the CFO of

Danone, Cecile Canabis, the main challenge of vitamin drinks in China is the

high competition, leading to short life cycles and small market shares of

highly-priced products.

According

to CCM, China is ranked second behind the USA in the number of energy beverage

sales in the global market. Recent growth number of up to 25% have caused high

attention by international enterprises to penetrate into this promising market.

It is expected that the domestic retail sales volume of functional beverages

will hit 15.04 billion litres by 2020, with a corresponding sales value of

USD23.78 billion.

Many

manufacturers are launching new products into the market to gain some market

share. One example is the aforementioned product Mi-PRD of the Mizone brand by

Danone. Even this product is not being able to buy in retail yet, the company

has already announced new beverages with exotic flavours like pineapple,

litchi, orange, mango, peach, and cucumber.

Nevertheless,

also China’s domestic manufacturers are launching new products in China’s

functional beverage market. Hangzhou Wahaha has introduced the new functional

drink Burnlaxy. Special ingredients, besides taurine and vitamins, are

ginseng, maca, and fresh ginger. The company has lost its market share of 4.9%

in 2012 to 0.9% in 2015. It needs to be awaited if the company can get market

share again with launching new functional drinks. Other successful products by

this company are Wahaha Get C and Hai Jing Lemon.

Feed Industry

According

to CCM, China’s feed industry is recovering in 2017 with a continuously rising

output of feed.

The

first quarter also saw prices of live pig in China continually falling and

meanwhile its breeding pig quantity decreased, affected by weak demand for pork

and environmental policies as well. The price is not likely to surge in the

foreseeable future.

After

all, China’s live pig market decreased steadily since February 2017, due to the

reduced market demand, pressure from pig farming regulations, as well as

competition with importers. The pork consumption in China has witnessed a

decline after the Spring Festival in early February. Furthermore, as a plan of

China’s government, a huge number of farmers need to move out of so-called

forbidden areas in China, relocating into economically supported zones for

livestock and poultry. The imports of live pigs also went up significantly by

almost 20% in Q1 2017.

However,

the figures did stablise in Q2 and might even climb up again in the third

quarter of 2017. Affected by the national restrictions in pig farming, the

quantities in breeding-forbidden areas will continue to reduce, and national

production capacity will not recover soon. Yet, farms in regions suitable for

pig faming may be active in purchasing new live pigs given the considerable

profitability. Therefore, live pigs on offer are expected to gradually increase

in H2, restraining possible price hike in the coming period.

Performance of key

enterprises

Hubei

Guangji Pharmaceutical is greatly affected by the strict environmental

regulations that are taking place in China currently, as the vitamin B2 and B6

production belongs to the heavy polluting industry. However, the investments in

better waste disposal has lowered the production costs on the other hand, which

actually improved the gross profit margin of many products.

Julong

Biological was able to increase the revenue in 2016, due to the excellent

performance of its L-tryptophan business. The revenue witnessed an increase by

more than 25%. The company is one of the world’s largest supplier of

L-tryptophan, which is being exported to many countries in Europe, America,

Southeast Asia and Australia. After all, this product made up more than half of

the total revenue share.

Bluestar

Adisso announced a weak methionine business in Q1 2017, while the specialties

business boomed. The strong performance can be mainly described with the stable

development of the company’s specialties as well as an efficient cost control

implemented by the factory administration. Bluestar

Adisso is the second largest manufacturer of methionine globally, only

following Evonik. The company had a global market share of about 27% in 2016.

While the price of methionine in China keeps falling, the demand is still

surging by about 6% on global markets.

Eppen

Biotech is currently preparing for the initial public offering. The company

underwent a rapid growth in recent years, reaching USD21.75 million in total

profit 2015. However, the company is still facing several challenges, according

to CCM’s research. One of the major challenges is regarding the environmental

pollution. Even the company, whose production of most products cause heavy

pollution, has already invested in and implemented new waste disposal systems,

the outcome is not enough to please the local government and nearby population.

Hence, Eppen Biotech is in great need to continue investing in environmentally

friendly production, or the IPO prospect, as well as the corporate valuation,

might be in danger. Another challenge detected by CCM are patents as well as

intellectual properties. The company was facing several issues of a lawsuit in

terms of patent violence in the past. Due to uncertainties of further patents,

the company may face similar issues in the future.

LHG

showed a mixed performance in 2016 and the beginning in 2017. Most of the

quarters witnessed a negative net profit. The company is mainly affected by a

fiercer competition in the MSG market, an amino acid which occupies about 80%

of LHG’s production. The market price of it is going down constantly in recent

months, leading to problems for the company. Also, the environmental pressure

from the government is bothering LHG, as the production of MSG is highly

polluting, which requires large investments for the company. However, despite

the mentioned problems, recent efforts in enlarging the product portfolio as

well as getting into new markets, the odds are well for the company to expand

further and become one of the giants in China‘s health industry.

Lianing

Wellhope was enjoying a steady growth of profit throughout 2016. The total

profit in 2016 even increased by more than 35% compared to 2015. However,

Wellhope is also facing the risk of China’s abandoned corn stockpiling policy,

which let the prices of corn, one of the main raw materials for feed products,

rise under uncertainty. However, China’s policy of implementing forbidden

farming areas in the country is benefitting the enterprise. Wellhope is stated

in one of the developing zones in the northeast of China, which offers the company

a great geographical, logistical and economical advantage to competitors. This

is due to the low distance to many raw material producers like corn farmers. In

addition to this, the area of Wellhope is also labelled as one of the key areas

for China’s pig industry, which offers some benefits in environmental

protection and pollution management.

Yongan

Pharmaceutical did witness a falling revenue in 2016, while the net profit

surged by more than 250%. Compared to 2015. This trend is explained by the company

with reduced production costs as well as a boom in demand for taurine and

related to this the rising prices. Yongnan Pharmaceutical is China’s largest

producer of taurine and ethylene oxide, a raw material used in the production

of taurine. The performance in 2015 was pretty bad, due to the low market price

of ethylene oxide and oversupply in the market. Taurine was making up for

84.35% of product revenue in 2016, followed by the second largest product,

Ethylene oxide, which only accounted for 6.14%. Looking at the product revenue

structure in 2015, taurine was only accounting for 73% and Ethylene had a

larger share with 17%. Yangnong Pharmaceutical is not only China’s largest

taurine producer but also worldwide, accounting for over 50% of global sales,

according to CCM. Notably, around 80% of the company’s production is used for

export. Especially in the feed sector taurine has become a highly-demanded

addition, since the use of antibiotics was restrained by the government and

taurine is showing itself as a good substitute for immunity enhancement.

China’s pharma industry

till 2020

The

State Council in China has recently released the five-year development plan for

China’s pharma industry, which gives a guidance for the further development of

this large industry and what players, domestic and overseas, can expect.

One

of the main goal is to cover the production of almost every branded drug

without patent protection in China, which will decrease imports significantly.

To achieve this ambitious goal, the government is going to encourage innovation

of new drugs and ease the approval for novel drugs to get market access. The

long process of this approval has been a thorn in many manufacturers’ eyes for

many years already.

Another

measurement is the building of well-equipped pharma industrial parks throughout

the country, where especially small and medium sized companies can target

highly selective drugs to develop and produce.

Speaking

of small and medium sized companies, the highly fragmented situation of China’s

pharma industry is one of the main challenges, which makes innovation so

difficult in the country. Hence, the government in Peking is encouraging

mergers and acquisitions to establish larger size companies with sufficient

resources for effective research and development.

Finally,

the new five-year plan is targeting the oversupply of generic drugs in China.

While novel drugs are going to be widely encouraged by the government,

oversupplied generics will be controlled. The Chinese government now demands

bioequivalence testing for generics to ensure the quality of those, and

furthermore encourages qualified third-party verification service providers to

also join the activities.

Meet CCM and Tranalysis at the Exhibition. You can easily arrange an appointment by going to our event page and fill out the appointment form.