China’s

cheese manufacturers are advancing fast to get their share in the high-speed

spreading cheese market in China. However, the main sales channels are still in

the food service sector, leaving a high potential for manufacturers to

penetrate into China’s retail market.

Source: Pixabay

According

to CCM’s research, the cheese industry in China witnessed increasing demand for

cheese during 2015-2016. The main sales channels hereby are food services like

hotels, caterings, and the baking business. To be more precise, the entrance

rate of cheese in China even reached 79%.

Even

the retail sector only accounts for 24% of sales in the whole cheese market in

China, the future looks very encouraging. According to the Cheese China 2016

Report by Mintel, retail sales are expected to rise at a CAGR of almost 13%

until the year 2021. Hence, the amount of distributed cheese would end up at

38,830 tonnes. Moreover, looking at countries around China, like Japan and

Vietnam, the potential for cheese sales in retail stores is shifting more

obvious. Those two Asian countries already have a retail portion of cheese at

about 41% and 73% respectively.

After

a strong infiltration of cheese into China’s 1st and 2nd tier cities

in previous years, the most attractive and fast growing opportunities for

manufacturers and traders can be found nowadays in the 3rd and 4th tier

cities in China. Especially bakeries and western style restaurants are

witnessing a surging demand for cheese from their customers.

China’s

dairy manufacturers have discovered the expanding interest and started to

getting into the cheese business as well. However, according to CCM, about 90%

of cheese in China is still imported, which is an amount of about 90,000 tonnes

yearly.

Imports and Exports

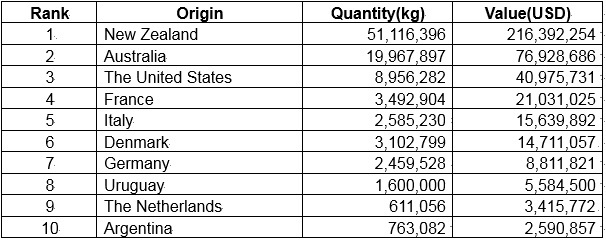

The

main exporting country for China’s cheese demand remains New Zealand with a

quantity of cheese export to China by more than 51 million kg and a value of

over USD216 million. The second rank is Australia with almost 20 million kg and

on the third rank can be found the USA with almost 9 million kg.

Top

10 exporting countries of cheese and curd in China, 2016

Source:

China Customs

The

top exporting countries of cheese and curd in China 2016 from China Customs

show, that China’ s cheese import is highly concentrated in the Oceania region,

while European countries, which are traditionally famous for cheese products,

are lacking behind.

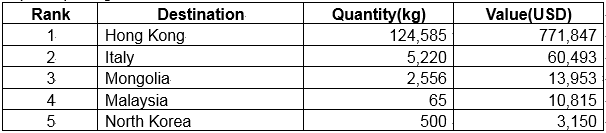

Nevertheless,

China is also exporting cheese to several countries, even if the main

destination is Hong Kong. Surprisingly, Italy is the second ranked destination

of cheese from China, according to the data from China Customs.

Top

5 importing countries of cheese and curd from China in 2016

Source:

China Customs

China’s manufacturers

increase efforts

For

Chinese manufacturers, the jump into the cheese business could be an effective

way out of the sluggish market trend of many dairy products in China. While the

purchase price of milk is constantly going down in the last years, the cheese

business is a promising upmarket diversification.

Currently,

only a few Chinese manufacturers have got a share in the cheese business by

delivering to brands like McDonald's, Milkana, and Savencia. The supplying

Chinese companies, according to CCM, are Bright Dairy & Food and Beijing

Sanyuan Food.

Other

companies in China are putting a lot of effort into the development of cheese

products to get their share in this rising market. One example is Yili, which

is developing a cheese product for the Chinese taste currently, with an unknown

launch date yet. China Mengniu Dairy is working on launching its own cheese

products as well, which demonstrates a diversification from its current product

portfolio, consisting only of cheese sticks for infants in this market. Also,

Ground Food wants to open a cheese processing factory in spring of 2018, which

will be capable of producing about 40,000 tonnes of cheese products yearly.

About CCM

CCM is

the leading market intelligence provider for China’s agriculture, chemicals,

food & ingredients and life science markets.

Do

you want to find out more about the Dairy market in China? Try

our Newsletters and Industrial Reports or join our professional online

platform today and get insights in Reports, Newsletter, and Market Data at

one place.

For

more trade information of cheese, including Import and Export

analysis as well as Manufacturer to Buyer Tracking, contact our experts

in trade analysis to get your answers today.