“In the recent

years, China’s economic data have boldly diverged, and thus it turned to be

more and more difficult to estimate the running condition of macro economy.

Under the background of the ongoing policies that designed for stabilizing

growth, how to explain the all-the-way investment downturn and data divergence?”

Source: Internet

Recently, China’s

economy faced a bold data divergence, which made it more difficult to estimate

the running condition of macro economy. For example, the main macroeconomic

data of July showed a wide depression and at the same time kept declining,

however, in August, the official PMI of manufacturing industry was 50.4 in

August, which was a record high in the previous 22 months and showed a positive

sign for economic growth, moreover, the hugely increasing industrial

enterprises profits and electricity output in July strongly contrasted with the

depressed industrial production and reducing investment.

The profit of

industrial enterprises above the designated size year-on-year increased by 11%

in July, 5.9 percentage point faster in terms of growth rate than that of June.

The year-on-year growth rate of the output of electricity generating increased

from 2.1% in June to 7.2% in July, but at the same time, the industrial added

value above the designated size increased by 6%, which was 0.2 percentage point

lower than that of June. Moreover, the investment on the fixed assets decreased

to 8.1% during January to July, which was 0.9 percentage point lower than that

of the period ranged from January to June. Under the ongoing policies that

aimed to stabilize the growth, it’s noteworthy that the investment has all the

way declined and the data have diverged.

What’s the logic

chain behind all those layers of mist? Would the economic situation be stabilized

or kept in the downturn?

The Divergence between the Reduction on the Industrial

Production and the Improvement on the Output of Electricity and Profits

One aspect that

worth paying attention to was the mystery of the divergence among the reducing

industrial added value, strong generating capacity, and increasing profit. According

to statistics, the industrial added value above the designated size increased

by 6%, which was 0.2 percentage point lower than that of June. However, the

profit of industrial enterprises above the designated size increased by 11%

year-on-year in July, which, accelerated by 5.9 percentage point than that of

June, created a record high in the previous four months. The output of

electricity and power consumption hugely increased in July: the year-on-year

growth of the former increased from 2.1% of June to 7.2% and of the latter

increased from 2.6% in June to 8.2%.

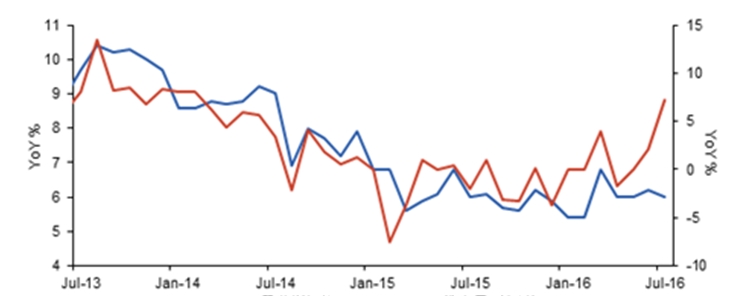

Graph 1:

Divergence between the Industrial Production and Generating Capacity

Industrial Added

Value Generating

Capacity (right axis)

Generally

speaking, there’s a strong positive correlation between the generated energy

and industrial production, and thus it’s really abnormal about this divergence.

The Statistical Bureau offered three reasons for this phenomenon: first of all,

the increasing electricity consumption due to the high temperature, secondly,

the short-term adverse effect on the industrial production caused by the flood disaster;

thirdly, the low cardinal number of the industrial electricity consumption. However,

the three reasons above were not solid enough as they still diverged from the

statistics.

About the first

reason, of course the high temperature would greatly influence the residential

electricity consumption and the consumption of service industry, and thus the

year-on-year growth rate of the residential electricity consumption in the

urban and rural areas increased from 5.4% of June to 9.6% of July, and that number

of the service sector increased from 8% of June to 15.3% of July. As the

electricity consumption of the residents and service sector only accounted for

25.6% of the total electricity consumption, the increasing electricity consumption

of the residents and service sector due to the high temperature just

contributed 1.5 percentage point to the increasing electricity from the overall

perspective.

Some views

believed that the high temperature also has been one of the factors that drove

up the electricity consumption in the secondary industry, for example, the

year-on-year growth rate of the electricity consumption in the secondary

industry increased from 1.4% of June to 6.9%, among which the growth of the

industrial electricity accelerated from 1.4% to 6.9% and the manufacturing

industry increased from 0.5% to 4.9%. But from author’s point of view, it’s not

reasonable to attribute the increasing electricity consumption of the secondary

industry to the high temperature: the July of 2010 used to be the hottest in

the same period of the recent years, but the year-on-year growth rate of the

July of 2010 slowed down from 15.8% of June to 15.4%, among which the

industrial electricity consumption growth reduced from 15.7% to 15.4% and the

consumption of the manufacturing industry declined from 19.8% to 15.7%.

As for the second

reason, we can find that the damage caused by the disaster in each province

were not exactly matched with the slowing down industrial production. For

example, according to the report analyzing the disaster condition of July

released by Ministry of Civil Affairs, provinces of Hebei, Hubei, Anhui, and

Henan were heavily suffered from disasters, while the industrial growth of all

those four provinces were 5.1%, 8.3%, 7.7% and 7.6% respectively, which,

respectively were 0.1, 0, 1.4 and 0.6 percentage point lower than that of June,

can be seen as a slight reduction. And in some areas that suffered disasters,

like Hunan, Guizhou, Jiangxi, Jilin, Beijing, and Sichuang, the growth of the

industrial added value in July was even higher than that of June. Provinces

with the highest reduction were not influenced by the disaster, for example,

the industrial added value of Xinjiang, Xizang, and Hainan were respectively

decreased by 7, 4.5 and 2.6 percentage point, which cannot be explained by the

side effect of flood disaster.

The third reason

was cardinal number effect. According to the statistics of Statistical Bureau,

the output of electricity of July last year decreased by 2.02% year-on-year,

but the author remained suspicious whether the flat cardinal number last year

caused the remarkable increase of the output of July this year? According to

Statistical Bureau, in July 2015, the output of electricity was 509 billion kilowatt-hour,

while in the same period of 2014, the output was 505 billion kilowatt-hour,

based on these two set of statistics we can get a year-on-year growth of 0.8%,

rather than the -2.02% released in the previous period. With the statistics of

no transparency, people would inevitably doubt about the explanation of

cardinal number effect.

Moreover,

according to the industry data, among all those 27 sectors, 18 of which enjoyed

an increasing growth rate of industrial added value, the emerging products of

consumption upgrading were prosperous in both production and sales. For

example, in January to July, the year-on-year growth of new energy automobile,

SUV, carbon fiber reinforced composite, solar battery, industrial robot, mobile

phone, and optical fiber were 94.6%, 37.7%, 36.7%, 26.4%, 27.2%, 23.8%, and

31.3% respectively. At the same time the high-value-added industries have also

been in good prospect. From January to July, the year-on-year growth of the manufacturing

of radar and its accessory equipment, tramway, and aerospace vehicle and its

accessory equipment, nuclear radiation processing, communication device

manufacturing, nuclear fuel processing, and battery manufacturing were 61.5%,

39%, 24.2%, 18.8%, 18.5%, 16.1% and 16% respectively.

*The

article is edited and translated by CCM. The original one comes from Laohucaijing.com.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For

more information about CCM, please visit www.cnchemicals.com or

get in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.