In 2015, China's export volume of paraquat TK recorded YoY soar while the export price kept falling sharply, according to analysts CCM.

China's pesticide market was stagnant in 2015 and the price kept falling. Paraquat, as the leading product in China's herbicide industry, the export volume of paraquat TK was114,796 tonnes in 2015, with a YoY rise of 43.89%, according to China Customs and CCM's export analysis.

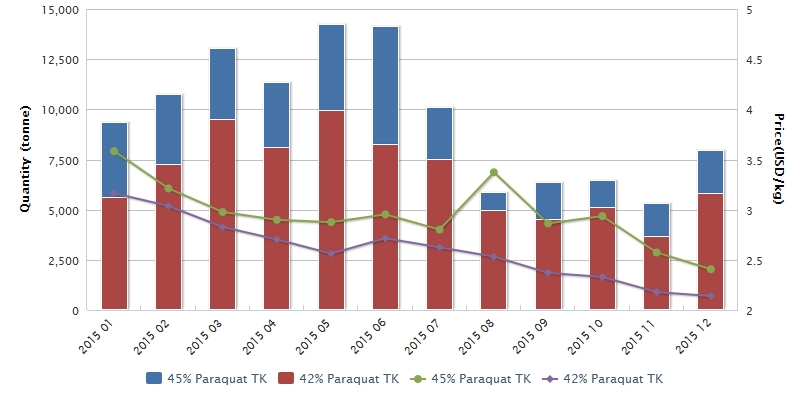

Exports of paraquat TK in China in 2015

Source: China Customs and CCM

The export volume of 42% paraquat TK reached 80,215 tonnes, up 33.81% year on year, accounting for 69.88% of the total. The export volume of 45% paraquat TK was 34,581 tonnes, up 74.39% year on year, a proportion of 30.12%.

Compared to H2 2015, the YoY rise in export volume of paraquat TK was larger especially in March-June, the traditional peak demand season.

However, the export price kept declining, with an average YoY fall of 29.28%. As a result, paraquat TK manufacturers faced the situation of profit drop despite the rising export volume in some way.

The export price of paraquat TK was USD2.78/kg, down 29.28% year on year. Thereinto, the average export price was USD2.60/kg for 42% paraquat TK, down 38.01% year on year. And that of 45% paraquat TK was USD2.95/kg, down 19.27% year on year, according to China Customs and CCM's export analysis.

Low export price of paraquat TK boosts the export volume

"In fact, the falling export price of paraquat TK boosted the export volume to some extent,” commented Chen Zaoqun, Editor of Herbicides China News.

"For part of rigid market demand, low price is easy to attract purchasers to stock up goods,” said Chen.

"In 2015, the Ministry of Agriculture of the People's Republic of China's attitude towards the future development of paraquat is not clear. Therefore, some overseas purchasers are worrying about the supply of paraquat in China and thus they stock up inventories when the price is low,”

"In the meantime, the progress in developing new paraquat formulation types is very slow, and TK enterprises have to promote their products to overseas market. The paraquat export price is hard to rebound under such fierce market competition” Chen added.

Regarding paraquat TK export destinations, Thailand ranked first by import volume of China's paraquat TK in 2015, whose import volume reached 19,218 tonnes, up 81.02% year on year. That of the US reached 11,109 tonnes, up 243.17% year on year. As a whole, the export destinations were concentrated. China exported pararquat TK to 42 countries/regions in 2015, of which the import volume of top 10 destinations amounted to 97,382 tonnes, accounting for 84.83% of the total.

Increasing TK’s export volume leads to fall of formulation’s export volume

Though the paraquat TK’s export volume increased greatly, the export volume of paraquat AS had a sharp decline.

Paraquat AS produced by domestic manufacturers in 2015 could no longer be sold in China's market. Now the paraquat AS sold at the market is produced before 1 July, 2014.

After losing the market share in China, the export market becomes the only chance of manufacturers. Some domestic paraquat enterprises reduced the output of paraquat AS.

However, both export volume and export price of paraquat AS reported sharp YoY falls in year 2015.

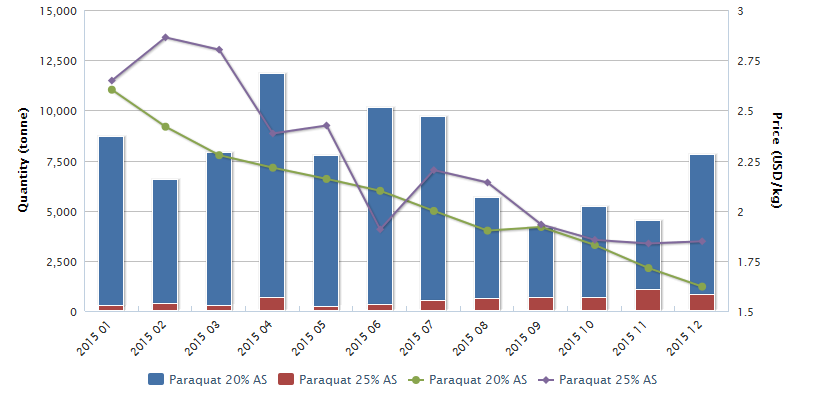

Exports of paraquat formulations in China in 2015

Source: China Customs and CCM

China only exported 89,840 tonnes of paraquat AS in 2015, a YoY fall of 60.61%. What's worse, the export volume of 20% paraquat AS (major exported formulation) was only 83,374 tonnes, down 62.61% year on year, accounting for 92.80% of the total export volume.

The good news was that the export volume of 25% paraquat AS showed a YoY rise of 26.28%, being 6,466 tonnes. But since its export volume only accounted for 7.20% of the total, such growth did not have great impact on the overall exports.

"Actually, the falling price of paraquat TK led to the decline of paraquat formulations’ export volume,” said Chen.

"With the falling price of TK, the foreign manufacturers tend to purchase the TK and produce formulation themselves,”

"The cost of producing formulations from TK may be lower than the prices of getting the formulations directly from China when they have to pay for the traffic expenses. That’s probably why the export volume of paraquat,”

"As for the exports of paraquat in 2016, there may be not many changes in the exports volumes in both TK and formulation,” Chen predicted.

Need more information about China’s paraquat market?

If you are looking for more detailed intelligence on China’s paraquat market, take a look at some of our latest research below:

Trade Data - you can find detailed data on every Chinese 2,4-D supplier and trader, and what specifications and prices they are offering, in our Import/Export Analysis reports

Newsletter - for breaking news, data and expert commentary on China’s herbicides market, download the latest issue of Herbicides China News

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.